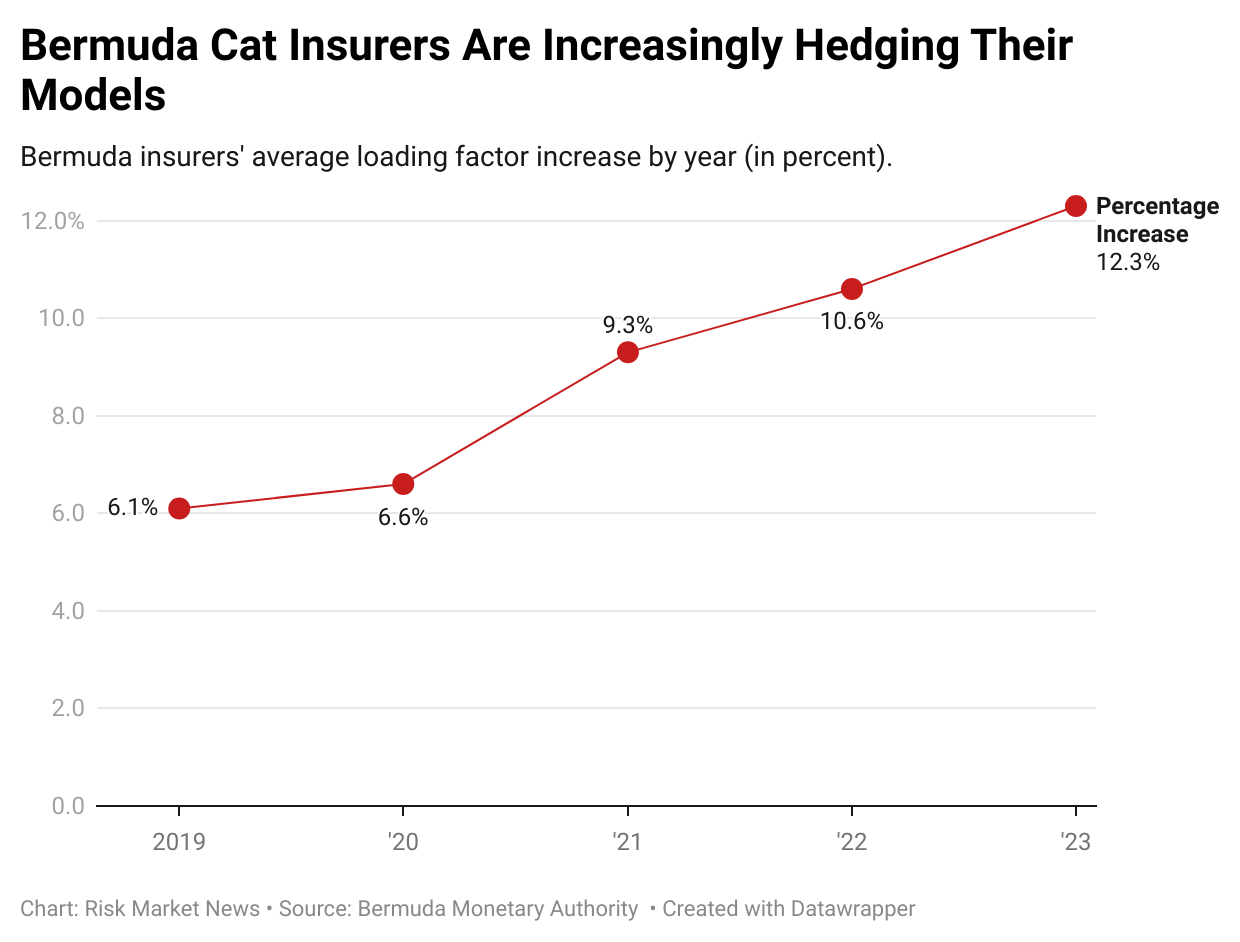

Insurers and reinsurers are hedging their loss projections at the largest margins ever, as losses continue to outpace catastrophe model projections.

Bermuda-based catastrophe insurers added an average of 12.30% to premiums above and beyond modeled prices—a new high and the fifth consecutive year they increased their "loading factor" within their risk accumulation processes. This increase represents a jump from 10.57% in 2022 and, more importantly, has more than doubled since 2019 as a multiplier of catastrophe price discovery.

The increase was disclosed in a Bermuda Monetary Authority (BMA) report released earlier this month and is based on the latest 2023 reportable data. Bermuda, as a domicile, represents the majority of the globe's catastrophe insurance and reinsurance capacity.