An update to the US Treasury's annual review of the insurance industry recently released has shifted to reflect three of the Trump Administration's broader financial market policy initiatives: cryptocurrencies, artificial intelligence and the threat of litigation.

The Federal Insurance Office's (FIO) 2025 Annual Report on the Insurance Industry marks a notable pivot in tone and content from previous editions, reflecting trends that it argues are reshaping the financial and operational foundations of the U.S. insurance sector.

Released in September, the report introduces several new sections that signal the federal government's expanding focus on the intersection of innovation, capital, and risk. These include deep dives into AI, digital asset insurance, and third-party litigation funding.

"Artificial intelligence (AI) is modernizing key areas of the insurance industry—such as underwriting, claims processing, fraud detection, marketing, and risk management," the report states, adding that AI has the potential to "streamline operations, lower operational costs, improve underwriting efficiency, and customize insurance policies."

The FIO places these developments within the broader context of the Administration's AI Action Plan released in July 2025, which aims to accelerate private sector innovation and U.S. leadership in AI adoption.

According to the report, 88% of auto insurers, 70% of homeowners insurers, and 58% of life insurers already use or are exploring AI and machine learning tools.

State regulators have moved in parallel. The National Association of Insurance Commissioners adopted its Model Bulletin on the Use of Artificial Intelligence Systems by Insurers in December 2023, which "reminds insurers that decisions impacting consumers… must comply with all applicable insurance laws and regulations." Twenty-three states and the District of Columbia have adopted the bulletin, while others are drafting model laws to regulate AI use more formally.

FIO signaled that it "will continue to monitor AI developments in the insurance sector and provide insurance expertise as part of Treasury's efforts related to AI adoption in the financial sector."

Treasury Pushes for Standardized Digital Asset Coverage Terms

Another new section in the annual report reflects the government's growing recognition of crypto-related exposures as a policy and market issue. Citing Executive Order 14,178, the report defines digital assets as "any digital representation of value that is recorded on a distributed ledger," and outlines steps to support what it calls the "responsible growth and use of digital assets."

Although still small, the commercial insurance market for digital assets is expanding, the report states. FIO estimates that approximately 20 insurers provide various types of commercial insurance for digital assets with limits up to $1 billion, with gross revenue between $1.94 billion in 2024 and $3.11 billion in 2025.

To strengthen that market, the office plans to "work with the insurance sector to create standardized terms, conditions, and policy language for digital assets" and to "engage with the NAIC and state insurance regulators on potential revisions to state regulations… including allowing insurers to invest in digital assets, as appropriate."

Third-Party Litigation Funding Emerges as 'Structural Risk Factor

The 2025 report also introduces a discussion of third-party litigation funding, connecting the growth of investor-backed legal claims to rising defense costs across P&C markets and a major talking point of the industry.

While insurer expenses declined slightly between 2023 and 2024, the report attributes much of the relief to state-level legal reforms, particularly in Florida, rather than a fundamental reduction in litigation activity.

The report points to "litigation funding by outside third parties," alongside class actions, high jury verdicts, and one-way attorneys' fees laws, as major contributors to rising costs.

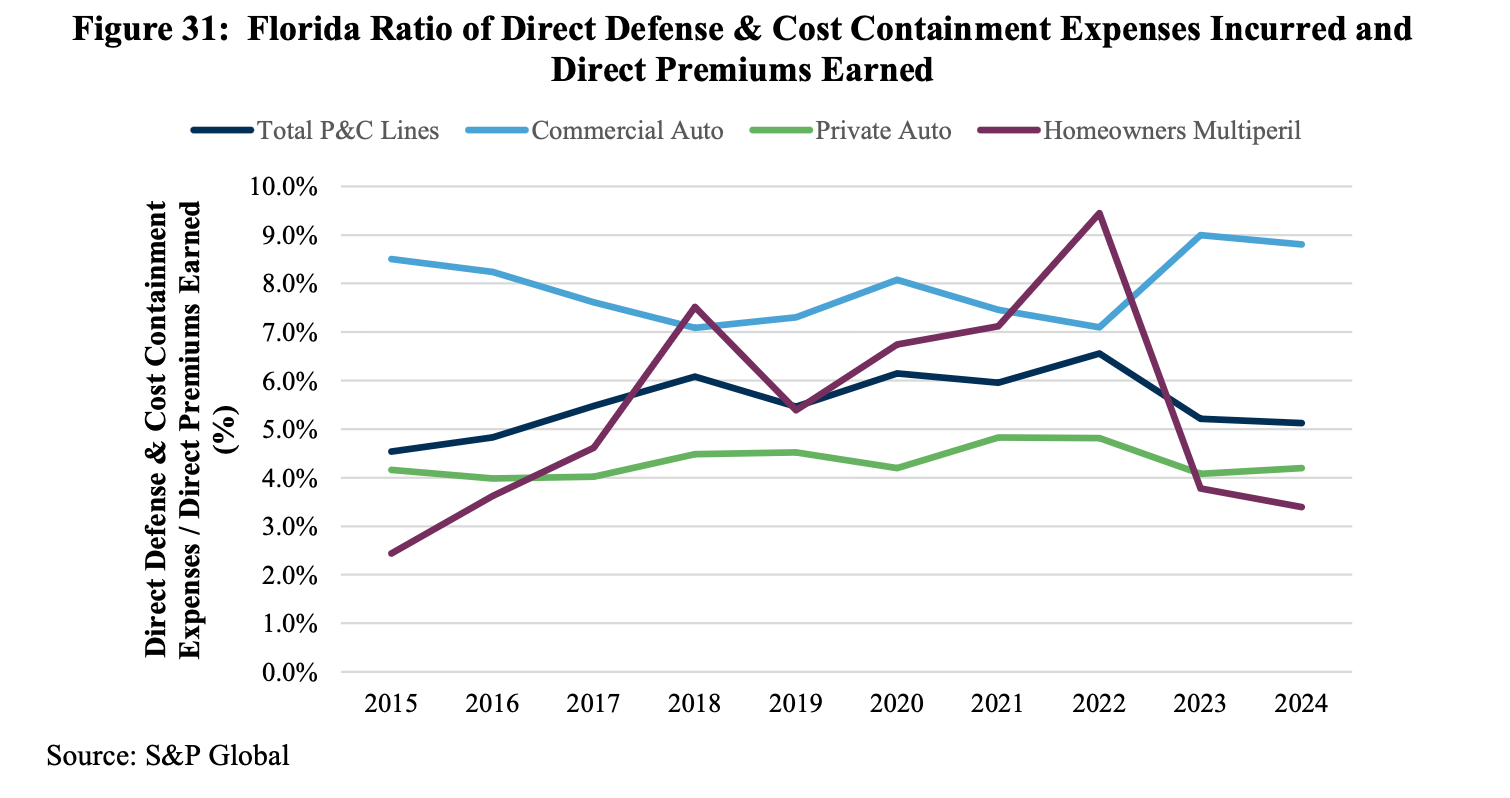

In response, Florida's recent legal reforms of eliminating one-way attorney's fees, restricting assignment of benefits, and tightening claims deadlines have helped reduce insurers' defense and cost-containment ratios from 6.6 percent in 2022 to 5.1 percent in 2024, according to the report. Nationally, those ratios have eased to 3.9 percent of direct premiums earned, down from roughly 4.5 percent in prior years, suggesting that while litigation funding remains a structural risk factor, targeted reforms can materially reduce its financial impact on insurers.

Life Insurers Turn to Private Equity Partnerships to Meet Obligations

The report also focused on a widening "retirement protection gap" as a driver of product innovation in the life and annuity space. According to the FIO, retirees face a "growing gap between the amount of money they have saved for retirement and the savings they will need in the future."

As a result, "there has been an increased consumer demand for individual and group annuities, which provide regular payouts over time," with sales of registered index-linked annuities (RILAs) and fixed indexed annuities (FIAs) reaching record levels in 2024.

The report notes that this trend is also transforming capital structures: life insurers "have increasingly become owned by or formed partnerships with alternative asset managers" to enhance investment yields and support long-term savings obligations.

FIO's Uncertain Future

The 2025 FIO report arrives as the office faces an uncertain future under the Trump Administration, with congressional Republicans and state insurance regulators pushing legislation to abolish the agency entirely.

In January 2025, Representative Troy Downing introduced the Federal Insurance Office Elimination Act, which has garnered support from major insurance industry groups and nineteen co-sponsors. The National Association of Insurance Commissioners made eliminating FIO a top federal priority for 2025, arguing the office "stands in direct conflict with the states' role as primary regulators" and duplicates data collection efforts.

A coalition of state insurance commissioners has urged the Department of Government Efficiency (DOGE) to work with Congress to eliminate FIO as part of the administration's mission to streamline federal operations.