A new analysis from McKinsey estimates that California faces a $1.35 trillion to $2.0 trillion homeowners insurance coverage shortfall driven by escalating wildfire exposure, a gap so large that the state is now entering a capital restructuring phase that spans both private insurers and the state-managed FAIR Plan.

The 2025 Los Angeles wildfires, which burned more than 50,000 acres and generated an estimated $35 billion to $45 billion in insured losses exposed structural market pressures that have been building for nearly a decade. Since 2017, eight of the ten largest insured wildfire loss events in U.S. history have occurred in California, the report notes.

Private carriers have pulled back accordingly. More than 100,000 homeowners lost private-market coverage between 2019 and 2024, many of whom moved directly to the state’s FAIR Plan.

Originally created as a temporary backstop, California’s FAIR Plan, backed by state law and funded by all admitted property insurers, was never intended to compete with the private market, but to provide coverage when carriers refused to write high-risk policies.

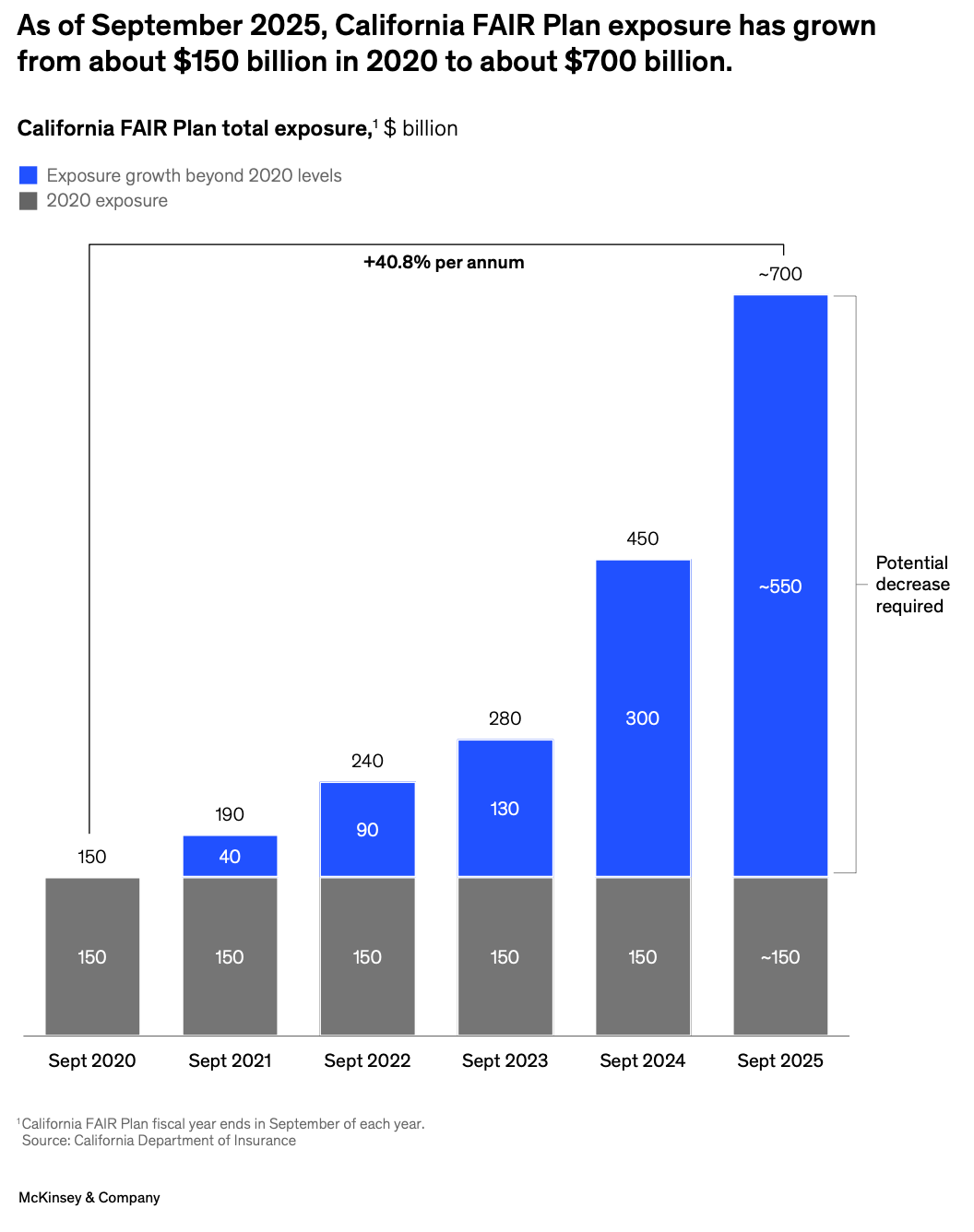

That temporary role has now expanded dramatically. McKinsey reports that “the FAIR Plan’s total exposure nearly quintupled over the past five years, reaching $700 billion in September 2025.” The plan has become the largest residual insurance market in the United States, surpassing Florida’s Citizens Insurance.

Yet the FAIR Plan currently collects just 0.28 percent in premium relative to exposure, compared with 1.5 to 2.0 percent in other catastrophe-prone states. McKinsey estimates that “restoring system stability… may require $8 billion to $10 billion in additional annual premiums — a 50 to 65 percent increase over the current homeowners insurance market.”

The report stresses that rate adjustments alone are insufficient to fix the system. California’s 2024 Sustainable Insurance Strategy, which now permits forward-looking wildfire catastrophe models and inclusion of reinsurance costs in rate filings , represents a material break from past constraints. But affordability and capital capacity must be addressed in parallel.

McKinsey’s Suggested Market Stabilization Framework

McKinsey recommends restructuring how wildfire risk is shared and financed and reducing concentrated exposure in both the FAIR Plan and insurer balance sheets.

- One option is a public–private reinsurance backstop modeled on Florida’s Hurricane Catastrophe Fund, where the state assumes a defined layer of tail risk.

- Another is a layered risk-sharing structure similar to the UK Flood Re or the U.S. Terrorism Risk Insurance Program (TRIA), where private carriers retain the first layer of loss, pooled capital absorbs the mid-layer, and the state only backstops extreme events.

- McKinsey also highlights the growing role of alternative capital, including parametric insurance and catastrophe bonds, though scaling these instruments depends on further improvements in wildfire modeling and basis-risk reduction.

In parallel, the firm stresses that risk reduction must advance alongside financial restructuring, through modernized building standards, retrofitting of older homes, wildfire-informed zoning, and large-scale vegetation management.

These efforts, McKinsey estimates, require $5 billion to $17 billion in additional funding and stronger cross-agency coordination.

McKinsey concludes that California “stands at a pivotal moment” as it shifts from retrospective to forward-looking risk pricing and begins designing new capital allocation models.

“Strengthening California’s insurance market will require targeted efforts to materially reduce risk, rebalance exposure, and attract private capital into high-risk regions,” the report states.