The rush by reinsurance brokers to set the stage for pricing expectations in the new year has begun, and according to the industry, things are looking optimistic.

Statements by Aon and Guy Carpenter released this week highlight the reinsurance sector's significant "flexibility" and "resilience" heading into 2025, underpinned by an influx of capital.

This marks a sharp turn from the past several years, during which capital shied away from the reinsurance sector, leading to corresponding price increases after years of losses—particularly in catastrophe-exposed lines.

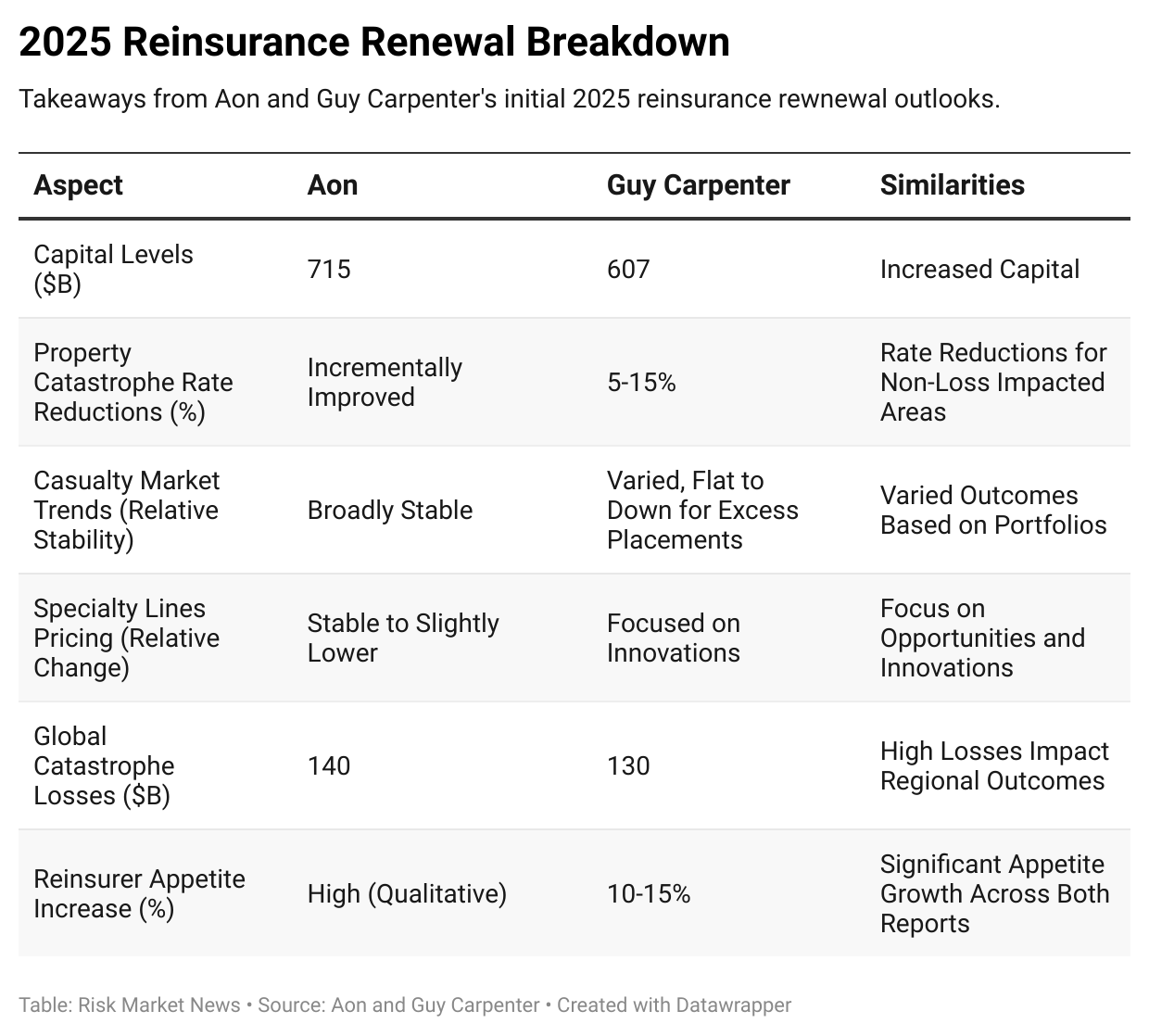

Aon estimates total reinsurer capital at $715 billion (driven largely by retained earnings) heading into 2025, while Guy Carpenter reported a comparable rise to $607 billion, citing discipline in pricing and attachment points. Both firms also emphasized an increased reinsurer "appetite for risk," supported by strong 2024 results and a focus on long-term market stability.

Rosy Headlines but Troubling Realities

The optimistic tone in both brokers' forecasts is driven by pricing and capital availability on "loss-free programs," or books of insured business that have not experienced significant losses in several years.