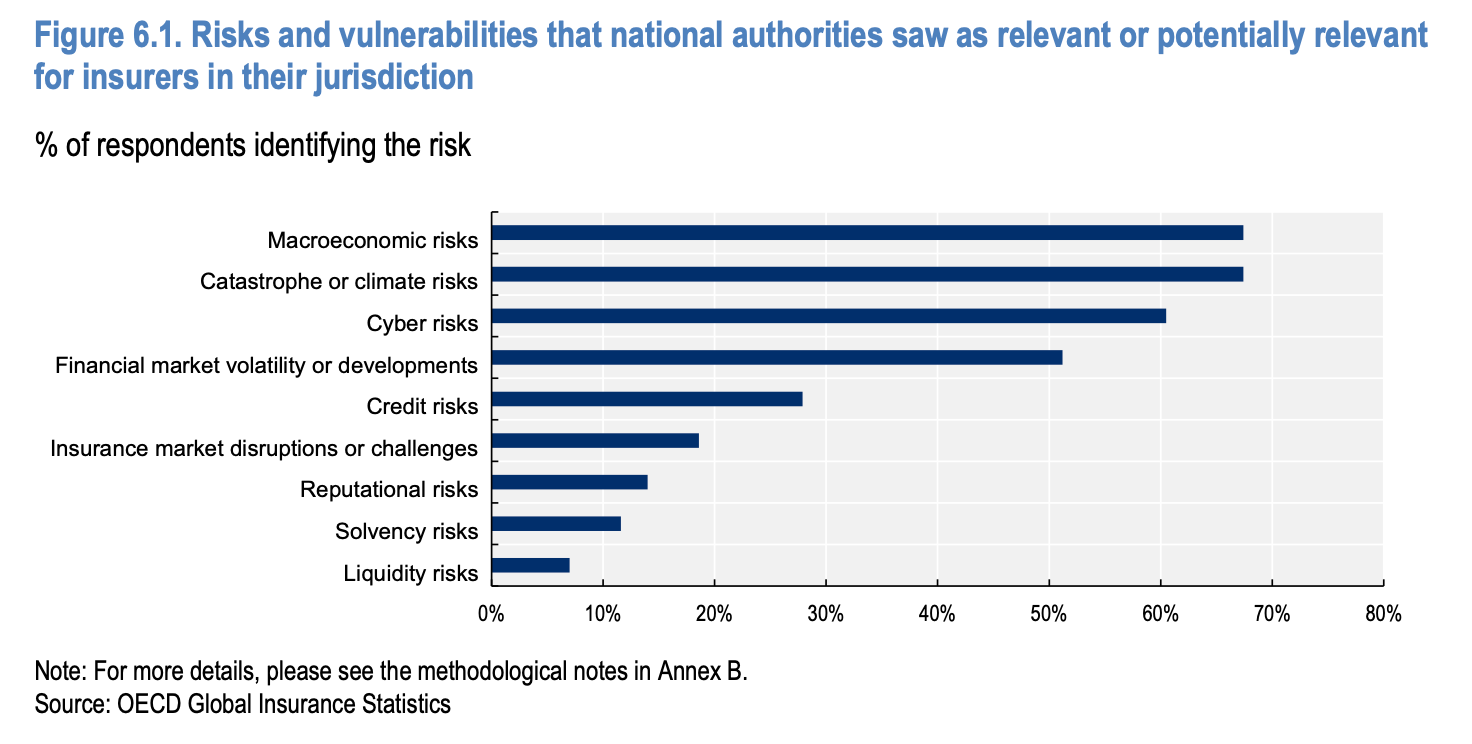

International insurance regulators say a converging set of pressures represent the most material risks facing insurers over the coming years.

The findings were released this week as part of the Organization for Economic Cooperation and Development’s (OECD) annual market trends survey of international insurance supervisors.

Regulators reported that inflation and interest-rate dynamics continue to shape both sides of insurer balance sheets. In several markets, elevated prices and income uncertainty are already affecting consumer behavior.

Australia noted that “uncertainty about the economic outlook and higher premium rates are key factors in policyholders lapsing their existing policies or underinsuring.” Mexico emphasized that high inflation can erode real benefit values in life products while inflating medical and auto claims costs, “compressing underwriting margins.”

France’s insurance regulators added that interest-rate risk is particularly acute given insurers’ heavy bond holdings, where “any sudden increase in interest rate volatility could affect insurers.”

Multiple countries — including Bulgaria, Ecuador, Greece, and Nicaragua — stressed vulnerability to natural disasters, with several expecting event frequency and severity to rise. France also signaled that disaster events remain “one of the main risks to which the non-life sector was exposed.”

Portugal identified earthquakes as its highest national-level concern, while floods, wildfires, and windstorms remain closely watched hazards. For markets with concentrated geographic exposure, the accumulation of secondary-peril losses is escalating supervisory concern.

Authorities also noted that deeper digitization, expanded cloud use, and growing dependence on external service providers have increased systemic vulnerability. Peru reported that digital transformation initiatives “have made cybersecurity a persistent risk for insurance companies,” while Australia warned of the “increasing frequency and sophistication of cyber-attacks” and the financial system’s interconnectedness amplifying operational exposure.

Denmark similarly cited cyber resilience as a top priority, particularly under the European Union’s Digital Operational Resilience Act (DORA).