📌 Reminder: The Risky Science Podcast Live starts next month. The first session is Cyber Risk in 2026: Modeling, Market Dynamics & Systemic Stress: Thursday, January 8 2026 at 1 p.m. EST.

Sign up to join the conversation.

Insurers, Reinsurers Warn IRS That Tax Fix Still Undermines Catastrophe Capital

Insurers say that a recent tax reporting fix still threatens the capital they rely on after major catastrophe-loss years.

Brookfield Wants To Take “As Little Risk As Possible” Toward Global Insurance Market Share

Brookfield says its P&C strategy will avoid catastrophe exposures and instead target niche sectors, like construction, where its ownership expertise creates an underwriting edge and reliable float.

California Warns Landslide Modeling Still Urgently Needed

California says even as its wildfire aid request shrinks, federal funding for landslide hazard mapping and modeling remains critical to preventing further losses across Los Angeles County.

Hartford CEO: AI Will Fuel Growth Without More Staff

“If we’re going to grow $1 of premium, we will need fewer people most likely going forward.”

Swiss Re Wants to Turn Risk Capital Lemons Into Risk Services Lemonade

One of the world’s largest risk-capacity providers wants to pivot toward risk-intelligence services. But investors still have questions.

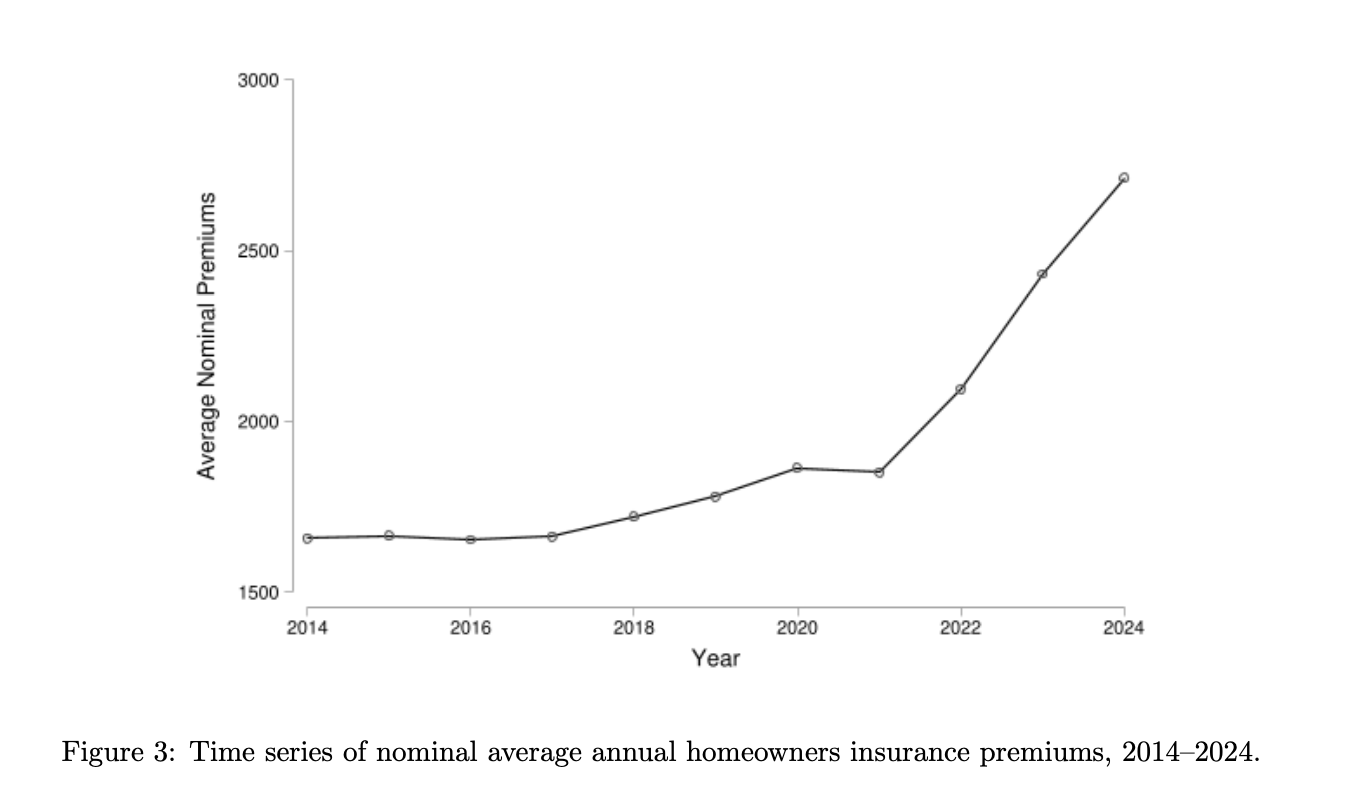

A fundamental shift is underway across U.S. housing and insurance markets, and it is beginning to show up in prices, mobility and capital flows, according to new research.

For years, rising property-insurance premiums were treated as a regional affordability issue or a post-disaster aftershock. But new research suggests the trend is broader, more structural, and increasingly driven by how capital markets are reassessing catastrophe risk.

This week on the Risky Science Podcast, we speak with Dr. Phillip Mulder of the University of Wisconsin, co-author of a new study that maps homeowners-insurance changes down to the ZIP-code level.

Mulder and his team use premium trends from mortgage escrow data (in about 20 million loans) revealing pricing pressures are accelerating and what is driving them.

The research argues that reinsurance “shocks” are spreading through the system, with the steepest premium increases occurring in areas where catastrophic losses tend to be highly correlated. Those include wildfire-exposed communities in California and large segments of coastal Florida.

While construction costs remain the biggest national driver of premium growth, Mulder says the widening gap between high-risk and lower-risk geographies is increasingly about the repricing of correlated climate exposure.

And that repricing is shaping housing markets, not just property insurance premiums.

In several high-risk areas, home price appreciation is slowing, more buyers are paying cash, and traditional mortgage borrowers are struggling with availability and cost of coverage.

For example, condo buildings in parts of Florida are being blacklisted by lenders because their insurance coverage no longer meets underwriting standards.

The question now is whether these pressures are the early phase of a climate-driven housing correction. As Mulder explains, when premiums change year-to-year but housing decisions last decades, friction is inevitable and increasingly unavoidable.