In the immediate aftermath of the Los Angeles wildfires, attention has turned to the insurance and reinsurance industries and the potential systemic risks posed by wildfire losses. Insolvency and carrier collapse, resulting from billions in unforeseen losses, could destabilize the wider regional or national economy, potentially freezing the financial system.

However, research published by Federal Reserve economists suggests that the greater destabilizing force of the wildfires on the U.S. economy may not stem from insurer defaults. Instead, it arises from an insurance system that manages to pay claims, traumatized borrowers accepting lower settlement offers, and a mortgage market awash with discounted "prepayments."

The scenario is striking: homeowners, devastated by the fires and eager to rebuild their lives, may use successful insurance claims to pay off their 20- or 30-year mortgages early. These claims transactions typically proceed smoothly, as borrowers trade the certainty of resolving their wildfire claims and clearing their mortgage debts for settlement amounts that are often significantly below their coverage limits.

Mortgage-backed securities (MBS) investors and lenders may avoid the risk of borrower defaults. Yet, the sudden influx of cash from billions of prematurely closed mortgages disrupts their financial models, creating "prepayment risk" that undermines their risk management strategies.

Much like the post-wildfire landscape, this financial disruption leaves a market permanently transformed.

Mortgage Market Becomes The Problem

The Federal Reserve researchers argue that, while investors and policymakers may focus on insurers for signs of stress or collapse, the true burden of wildfire risk will fall on downstream mortgage borrowers and lenders.

"Our results highlight that wildfires pose a larger risk to mortgage markets than previous research has indicated," the researchers stated.

While most analysts predict that insurers will withstand the losses from recent wildfires, the payouts may include settlements too low to cover rebuilding costs.

According to the Federal Reserve paper, nearly 40% of post-fire insurance claims are underpaid. This means the settlements received are lower than the coverage limits, which are typically based on insurers’ pre-event estimates of replacement costs for destroyed properties.

"A back-of-the-envelope calculation suggests that households receive about $200,000 to $300,000 less than their entitled amounts under California law," the researchers noted.

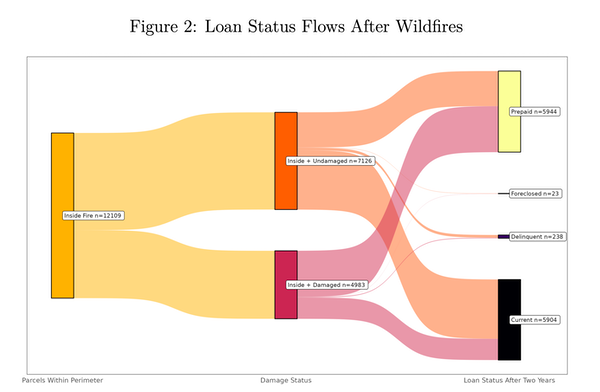

Consequently, borrowers who find their insurance settlements insufficient to rebuild may instead prepay their mortgages and move on. Public records support this implication: only 8% of property owners with fire-damaged homes file construction permits within two years of a wildfire.

These findings indicate that the rise in prepayments reflects friction in the insurance market, leaving households with settlements adequate to cover their mortgages but insufficient for full reconstruction.

The research also reveals a significant increase in both mortgage delinquency and prepayment rates within three months of a wildfire affecting a property. Mortgage delinquency rates increase by up to 4 percentage points, while prepayment rates surge by as much as 16 percentage points. By comparison, the average delinquency rate prior to a wildfire is 1.35%, and the average prepayment rate is 2%.

For lenders, servicers, and investors, insurance effectively shifts the default risk associated with natural disasters toward prepayment risk. Even if damaged properties rarely default after a wildfire in our loan sample, the increase in prepayment can lead to lost interest revenue. In fact, we observe that, among damaged properties, mortgages with higher interest rates are more likely to be prepaid.