Commonwealth Bank of Australia (CBA) issued a report last week that said that more than $31 billion of its home loans are in areas exposed to increasing extreme weather events such as cyclones, bushfires and flooding, according to internal models.

That means about 3% of the CBA’s loan portfolio is located in regions that are being hit by catastrophes linked to increases extreme weather events driven by greenhouse gas increases.

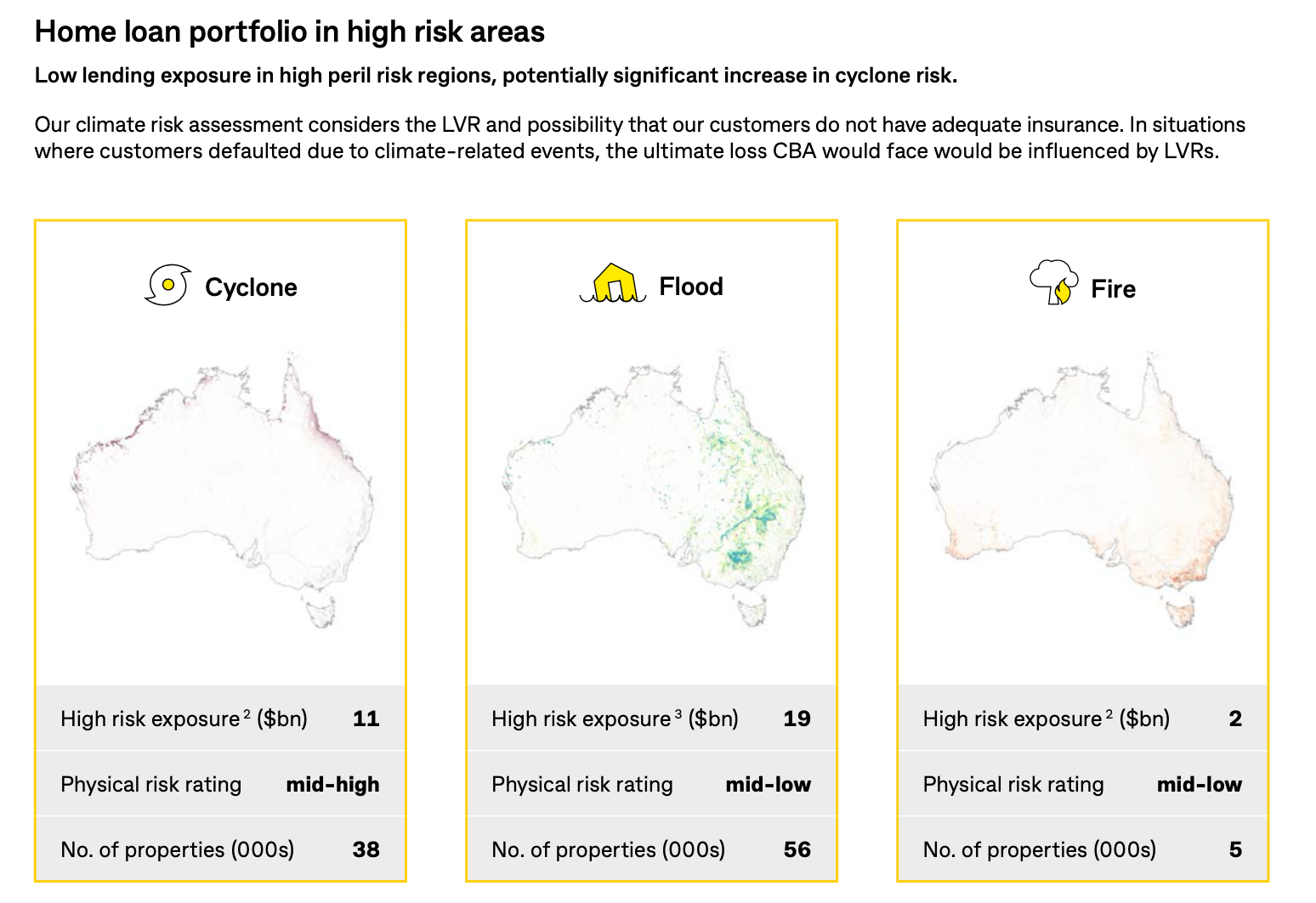

“In particular, peril risk ratings reveal increases in cyclone, flood and fire risk by 2050 under a representative concentration pathway, with more pronounced impacts to cyclone risk,” the report said.

A Representative Concentration Pathway is a greenhouse gas concentration trajectory used by the Intergovernmental Panel on Climate Change

According to the report, CBA’s models say that approximalty $11 billion in mortgages are a high risk of losses following a cyclone, representing 38,000 properties. The report added that models show that $19 billion worth of loans are at high risk of flooding (56,000 properties) and $2 billion are facing increases risk from wildfires (5,000 properties).

According to the CBA, learned global climate models and “downscaled” them to Australia and New Zealand. For downscaled projections, the report stated that it “relied on data used by the insurance industry to model the impact of natural perils in real estate.”

“We then use multiple modelling techniques to estimate the impact of physicalclimate risk or transition climate risk on credit losses.” The CBA report said. “This draws on internal expertise in climate and credit loss modelling.”