Citing the “significant” increase in the amount of alternative capital being used by the industry, state insurance regulators are proposing new disclosures of insurance-linked (ILS) holdings within insurers’ financial statements with an eye towards expanding the requirements in 2016.

Staff from the National Association of Insurance Commissioners (NAIC) approved a new narrative disclosure requirement ties to the ILS holdings for for U.S. insurers and reinsurers during their fall meeting.

“Although the use of ILS is often viewed as an alternative to the use of traditional reinsurance, ILS generally would not meet the risk transfer requirements of a reinsurance agreement,” says a statement from the NAIC’s Statutory Accounting Principles Working Group. “These disclosures are intended to capture information regarding the use of these securities for subsequent review and assessment.”

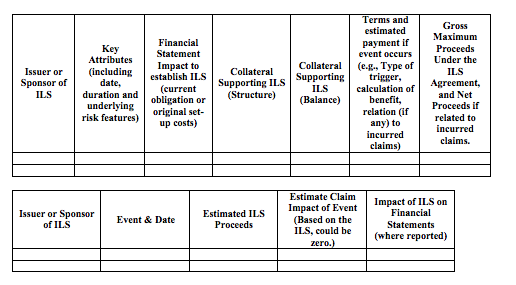

Specifically, the disclosures would require U.S. insurers and reinsurers report the number of outstanding ILS contracts as well as the “aggregate maximum proceeds” that could be received under the terms of the ILS for December 31, 2015 financial statements.

Going forward, however, the NAIC staff recommended further disclosures that will move away from a narrative form to more data intensive listing. Other disclosure recommendation by the NAIC in 2016, according to documents, include:

- Would the reporting entity benefit (receive proceeds) as a result of a triggering event related to an insurance-related event through some form of insurance-linked security? (Cat bonds are one example of ILS, but this question is intended to capture any security linked to the possible occurrence of pre-specified events related to insurance risks in which the triggering event provides benefits to the reporting entity.)

- What are the specific underlying risk features included in each ILS?

- What are the salient terms to establish the ILS agreements, including whether (and where) obligations related to ILS are currently reported on an entity’s financial statement? (If the reporting entity routinely submits payment to the sponsor (“premiums”) over the term of the ILS, provide details of the terms, payment structure and financial reporting for the transaction/security.)

- If a triggering event occurred, what would the reporting entity expect to receive under the ILS, and how would this be reported in the financial statements? What is the gross maximum benefit the reporting entity can receive under the ILS.

Following a review of the 2015 disclosures, the NAIC will consider the more detailed “data capture” methods in 2016.