Thanks for subscribing to the free Sunday newsletter version of RMN. Below are some of the stories that weekday subscribers were able to access.

Private Credit Is Boosting Blackstone’s Bottom Line And Insurers Are Fueling It 🔏

Axis Takes $425M Reserve Hit Following Strategy Shift

Norway’s Gjensidige Forsikring “Diligently” Working On Updated Storm Model 🔏

Coming Catastrophe Model Updates Are “Positive” For Industry: Conduit Exec 🔏

Become a premium subscriber to RMN to access all content.

What began as one-off response to a midwest flooding event in 1948, the US Disaster Relief Fund (DRF) has grown into a key fiscal tool for lawmakers to respond natural disasters in the US.

But with the number of multi-billion dollar natural catastrophe increasing – and budgetary curbs likely in a politically charged deficit debate – a new report by congressional analysts says that it may be time to rethink the federal government's fiscal approach to increasing disaster losses in the US.

"The central question for disaster relief budgeting is this: Does disaster relief represent enough of a priority for the federal government to maintain the status quo not withstanding potential increasing costs?" said a report issued by the Congressional Budget Office (CBO) last week.

The federal Disaster Relief Fund is "one of the most-tracked single accounts funded by Congress each year" according to the CBO. It's managed by the Federal Emergency Management Agency (FEMA) and is authorized under the Robert T. Stafford Disaster Relief and Emergency Assistance Act of 1988.

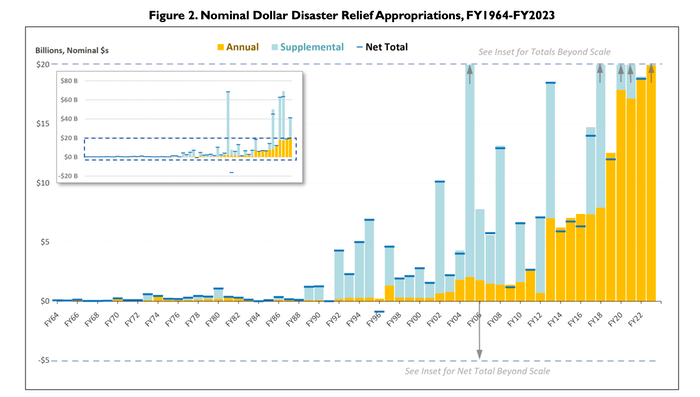

The federal government's tab tied to catastrophes has exploded over the past decade. According to the report, the DRF has received more than $175 billion in appropriations over the past four years, a "historic high" for the half-century old program.

However, even with that massive fiscal injection at the end of 2023, the fund was left with balance of only $2.55 billion available for to respond to other major disasters.

While the scope and role of the DRF has been expanding since its Truman-era founding, the CBO says the modern ballooning of Congressional disaster appropriations has been driven by two factors: the frequency and severity of natural disasters and the ongoing recovery costs from previous disasters.

The report points out the contrast in federal disaster funding between the relatively "calm" period for natural disasters of the 1980s to the era of high-frequency, high-impact events since 2012.

The report adds that the last seven fiscal years were among of Congress injecting funds into the DRF. In addition, the top four years of disaster fund spending occurred between fiscal year 2020 through fiscal year 2023.

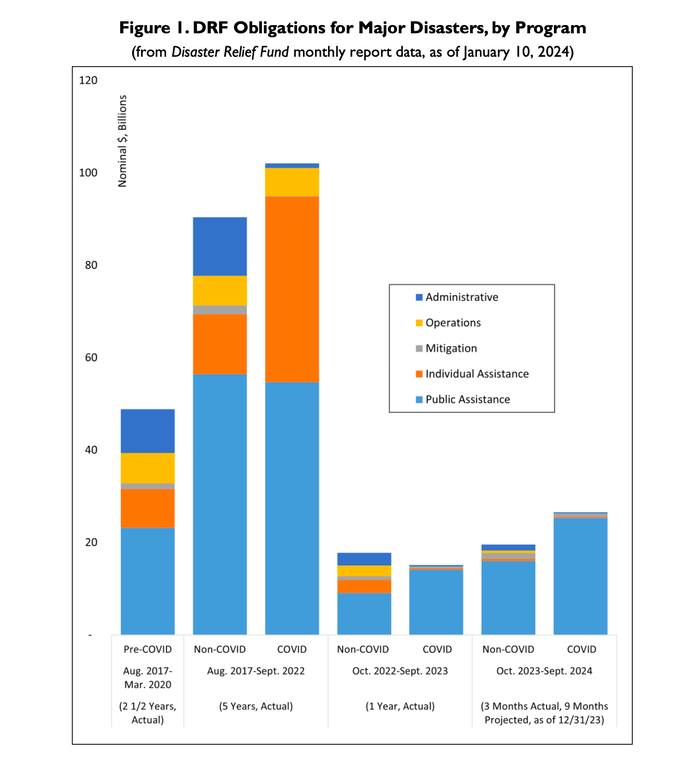

Another critical force in the increase of the federal disaster relief program was COVID-19 and the Trump Administrations "unprecedented" leveraging of the DRF to provide a fiscal response to the pandemic.

More than $120 billion had been obligated for COVID-19 pandemic response and recovery through the DRF by the end of the first quarter of this year, which CBO analysts pointing out is more that had been appropriated to the fund from its inception through 2004.

The CBO says that while disaster relief is a "relatively small part of the discretionary budget" and smaller part of the overall federal budget, disaster relief spending is anticipated to continue growing in the coming years and lawmaker may have no option but to rethink its funding approach.

"In modern history, Congress has been generally willing to provide resources for major disasters on an as-needed basis," the CBO report says. "However, discussions of deficit and debt continue in Congress, and with the expiration of the Budget Control Act’s discretionary spending limits and the statutory adjustment for disaster relief at the end of FY2021, new agreements will need to be reached"