A new Federal Reserve study examining FEMA’s redrawing of flood maps finds that when properties are removed from Special Flood Hazard Areas (SFHAs)—allowing residents to forgo mandatory flood insurance—mortgage lenders respond almost immediately by charging higher interest rates.

The research, released last month, analyzed roughly half of all properties in Orleans Parish that were removed from SFHAs in 2016, eliminating the requirement for homeowners to carry flood insurance. According to the study, banks reacted by charging “roughly 6 basis points higher” mortgage rates on properties no longer subject to the insurance mandate.

The economic impact of lenders’ response is substantial. The 6-basis-point rate increase is “equivalent to a 30-unit decrease in the FICO score of an average borrower,” underscoring how heavily flood-insurance requirements factor into mortgage pricing.

The authors calculate that “by raising mortgage interest rates 6 bps, banks were able to divert roughly one-quarter of these estimated savings away from households” that no longer had to pay mandatory NFIP premiums.

Banks also required larger down payments. Loan-to-value ratios for properties removed from the SFHA temporarily declined by about two percentage points relative to control properties—equal to “roughly $6,600 for the average treated property.” Together, these pricing adjustments indicate that lenders viewed the removal of mandatory insurance as a meaningful increase in risk.

Importantly, the pricing effects proved temporary.

After a significant 2017 flooding event in the same region, insurance take-up rates between properties with and without mandatory flood-insurance requirements converged.

As the report explains, “The claims data show no discernible difference in insurance take-up between treated and control properties, suggesting that many homeowners of treated properties voluntarily retained their flood insurance despite no longer being required to do so.”

The research also highlights more nuanced risk assessment by lenders.

The strongest pricing effects occurred among properties closest to the new flood-zone boundaries, where underlying flood risk was essentially the same. As the authors note, “our main findings are importantly driven by properties that are closest to the new flood map borders where empirical proxies of flood risk are nearly identical across treatment and control properties, leaving the insurance requirement as the main difference between the two.”

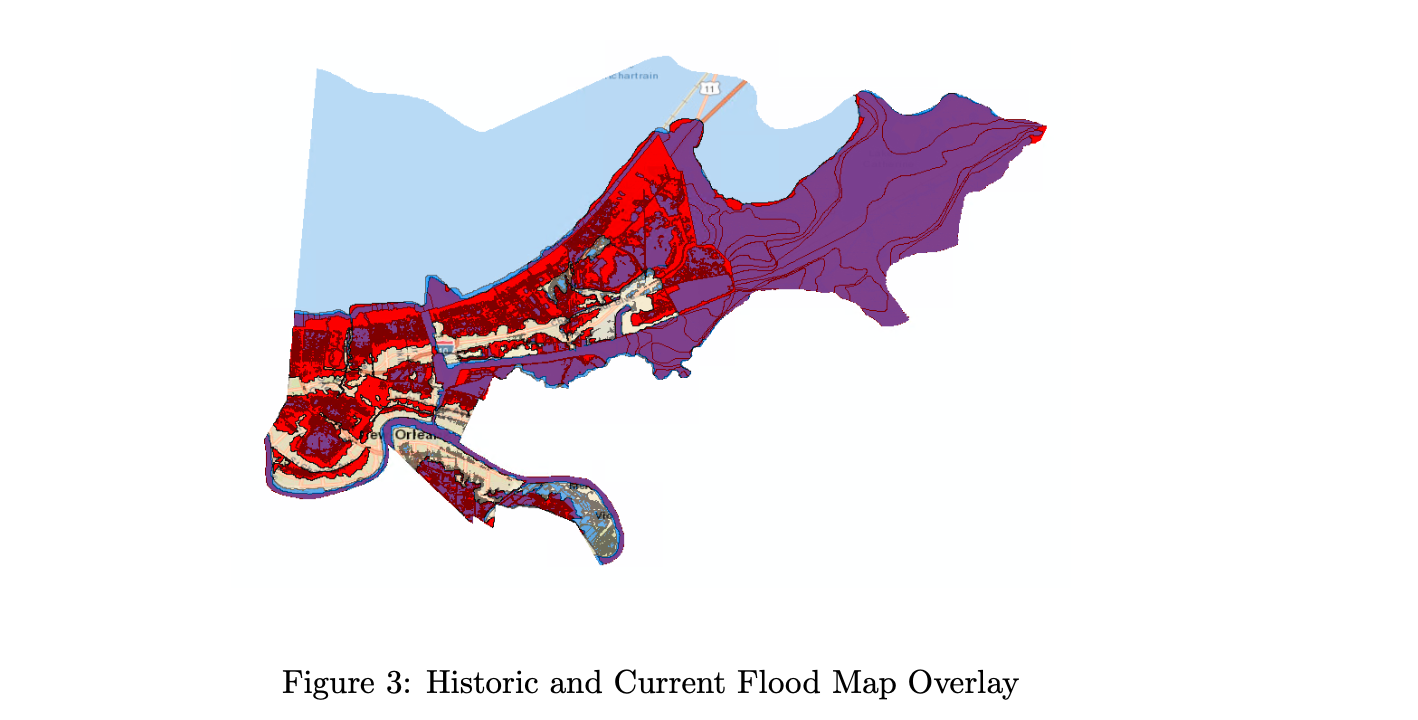

FEMA’s 2016 overhaul was the first major update to New Orleans’ flood maps in more than three decades, incorporating new elevation data and post-Katrina levee improvements that significantly reshaped the city’s assessed flood risk.

The revisions moved large portions of the parish out of high-risk zones, lowering insurance requirements for many homeowners and sparking debate among historians and flood experts who warned the new maps understated the city’s true exposure to recurrent flooding.

---