On the heals of a US Supreme Court decision that struck down a Biden Administration’s scheme to cancel student loans, a government financial watchdog is floating the idea of canceling billions in debt owed by the perennially-in-crisis National Flood Insurance Program (NFIP).

The U.S. Government Accountability Office (GAO) issued a report Monday arguing that canceling $20.5 billion in “legacy debt” owed by the NFIP would free current policyholders from paying for bills “they were not responsible for incurring” and would allow future policyholders to “pay only for their own flood risk.”

The authors said that if Congress canceled the flood program’s crippling debt it would “make insurance more affordable, thus encouraging consumer participation and resilience.” The GAO explained that the move was not with precedence since Congress canceled $16 billion in NFIP debt in October 2017.

“In one sense, canceling the debt transfers costs to taxpayers because current and future policyholders would no longer be paying interest on the debt,” the report says “However, because it is not likely that current and future policyholders will be able repay the debt under current rules, the cost has essentially already been transferred to taxpayers. “

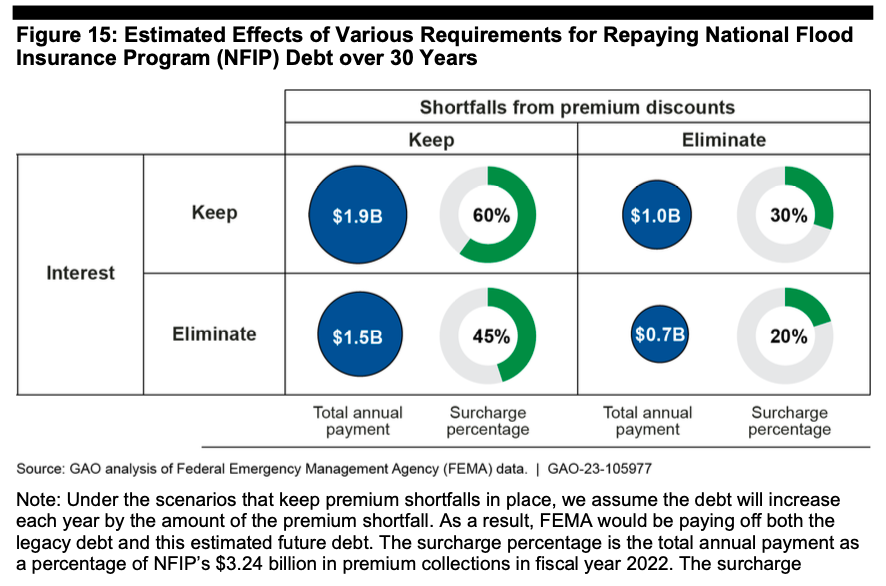

The report also points out that if Congress was unable or unwilling to cancel the NFIP’s debt, government officials or policymakers could “modify” the repayment terms that would involve a policyholder surcharge covering the debt’s principal — forgive the interest — and charge full-risk premiums.

“All of these options would involve substantial costs to future policyholders, which would both exacerbate affordability concerns and charge policyholders premiums significantly greater than are actuarially justified,” the GAO report said.

Risk Rating 2.0 is actuarially “limited,” private market on the sidelines

The GAO proposals are part of a larger update on the progress of NFIP’s Risk 2.0 program that was implemented in 2021 as a way to address the its continuing fiscal problems by promoting “actuarially sound” ratemaking and increasing premiums for properties at most risk.

But despite that goal, the Risk Rating 2.0 program has had limited success since a large chunk of the flood insurance premiums are exempt from “risk based” prices and implementation has resulted in uneven and wide swings in affordability.

“Risk Rating 2.0 does not yet appear to have significantly changed conditions in the private flood insurance market because NFIP premiums generally remain lower than what a private insurer would need to charge to be profitable. Further, certain program rules continue to impede private-market growth,” the GAO says.