Today’s issue of Risk Market News is free for everyone. Subscribers get access exclusive reports during the week.

Group and corporate discounts are available. If you want more information on group discounts you can contact me by clicking here.

Buffett Remind’s Everyone Berkshire’s Float Has a Very Long Tail

The release this weekend of Berkshire Hathaway’s annual shareholder letter and report gave chairman Warren Buffett an opportunity to remind investors that the engine that drives its profits access to investable “float” fueled by premiums from insured risks.

This collect-now, pay-later model leaves P/C companies holding large sums – money we call “float” – that will eventually go to others. Meanwhile, insurers get to invest this float for their own benefit.

But those insured risk have long tails that produce some serious near-term losses.

Mistakes in assessing insurance risks can be huge and can take many years – even decades – to surface and ripen. (Think asbestos.) A major catastrophe that will dwarf hurricanes Katrina and Michael will occur – perhaps tomorrow, perhaps many decades from now.

Buffett bet big on long-tail risks in 2017 with the agreement sign a excess-of-loss retroactive reinsurance deal with AIG for $10.2 billion. It was one of the largest retro deals ever, putting Berkshire subsidiary National Indemnity Company on the hook for four-fifths of all losses above $25 billion, up to $20 billion, in exchange for a payment of $9.8 billion from AIG.

The bet on a long tail came just after a similar $1.5 billion deal of coverage for asbestos with The Hartford.

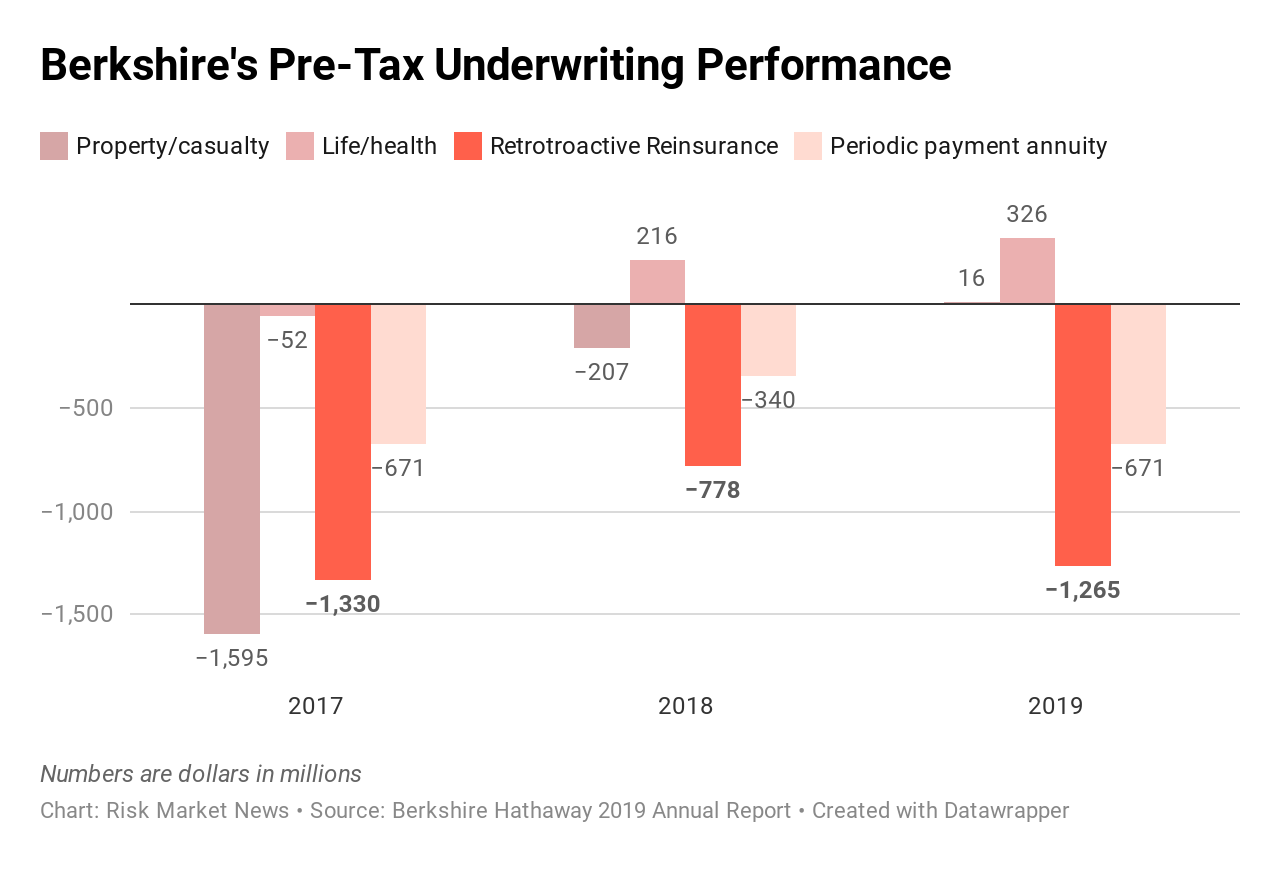

Thus far, the retro deals are hurting more than helping, with Berkshire disclosing that its retroactive reinsurance contracts generated pre-tax underwriting losses before foreign currency gains/losses of $1.1 billion in 2019, following losses of $947 million in 2018 and $1,06 billion in 2017.

Despite the poor performance, Buffett argues that the retro business will pay off in the long-run even if the proverbial “Big One” hits.

“The Big One” may come from a traditional source, such as wind or earthquake, or it may be a total surprise involving, say, a cyber attack having disastrous consequences beyond anything insurers now contemplate. When such a mega-catastrophe strikes, Berkshire will get its share of the losses and they will be big – very big. Unlike many other insurers, however, handling the loss will not come close to straining our resources, and we will be eager to add to our business the next day.

South Carolina Wants to Build Florida's Private Flood Market

(For Subscribers)

Taking its cue from Florida, South Carolina is now pushing legislation that would encourage the creation of a private market for flood insurance.

Private Market Readies For Coronavirus Exclusion Battles

Private market insurers, long hailing their prowess and developing products for catastrophic business interruption events, are already consider ways that may exclude BI claims from the current COVID-19 outbreak.

In an interview on Bloomberg TV Finley Harckham, senior litigation attorney at Anderson Kill, said that insurers are mulling ways to exclude coverage.

There are various defenses and hurdles to coverage for these losses from the coronavirus. The biggest one perhaps is that, in order for there to be a business interruption coverage, there needs to be property damage somewhere in the chain of disruption.

Hackerham said that property damage in the context of an epidemic or pandemic is when the virus is detected, causing the property to be taken off line. For example, the Diamond Princess cruise ship that was docked where COVID-19 was proven to exist.

An article in the Wall Street Journal points out that many insurers have already been proactive about excluding epidemics and pandemics.

Since the SARS outbreak, insurers added specific exclusions for bacterial or viral outbreaks to our insurance coverage,” said a spokeswoman for Yum China Holdings, which operates Pizza Hut and KFC in China and is the country’s biggest restaurant group.

Business that are shuddered because of a local or regional quarantines may be out of luck. Hackerham added that insurers are already preparing for their claims.

The insurance companies have various defenses and they will pursue them

Flood Re Creating “Ghettos”, Gutting Small Business

The effectiveness of the UK’s Flood Re program is being questioned by a series of reports issued last week.

Over 70,000 residential properties built sine 2008 in the UK are ineligible for flood insurance trough Flood Re, according to a report by Bright Blue, creating “flood ghettos” in the country.

The report states that Flood Re’s original mandate to avoid “moral hazard” by limiting to only covering properties built before January 2009. But that decision has redlined several communities from flood insurance coverage.

We should consider that the 2009 cut-off, rather than reducing exposure, may have simply left unwary homebuyers, to use an inappropriate expression, ‘high and dry’. As they are not covered by Flood Re, concentrations of post-2008 properties in high flood risk areas, such as new estates, are naturally some of the most vulnerable in the country to becoming ‘insurance blackspots’.

Separately, another report issued UK’s Federation of Small Business (FSB) said that up to 75,000 companies would not be able afford flood insurance costing the UK economy up to £1 billion.

According to a Times of London report, recent floods are causing insurers to target small business:

Insurance industry sources said that premiums would rise sharply after storms on successive weekends this month. Some brokers are said to be demanding more than £100,000 for cover in new policies. “You just need to look at the pictures. Small businesses are being crucified,” said one broker.