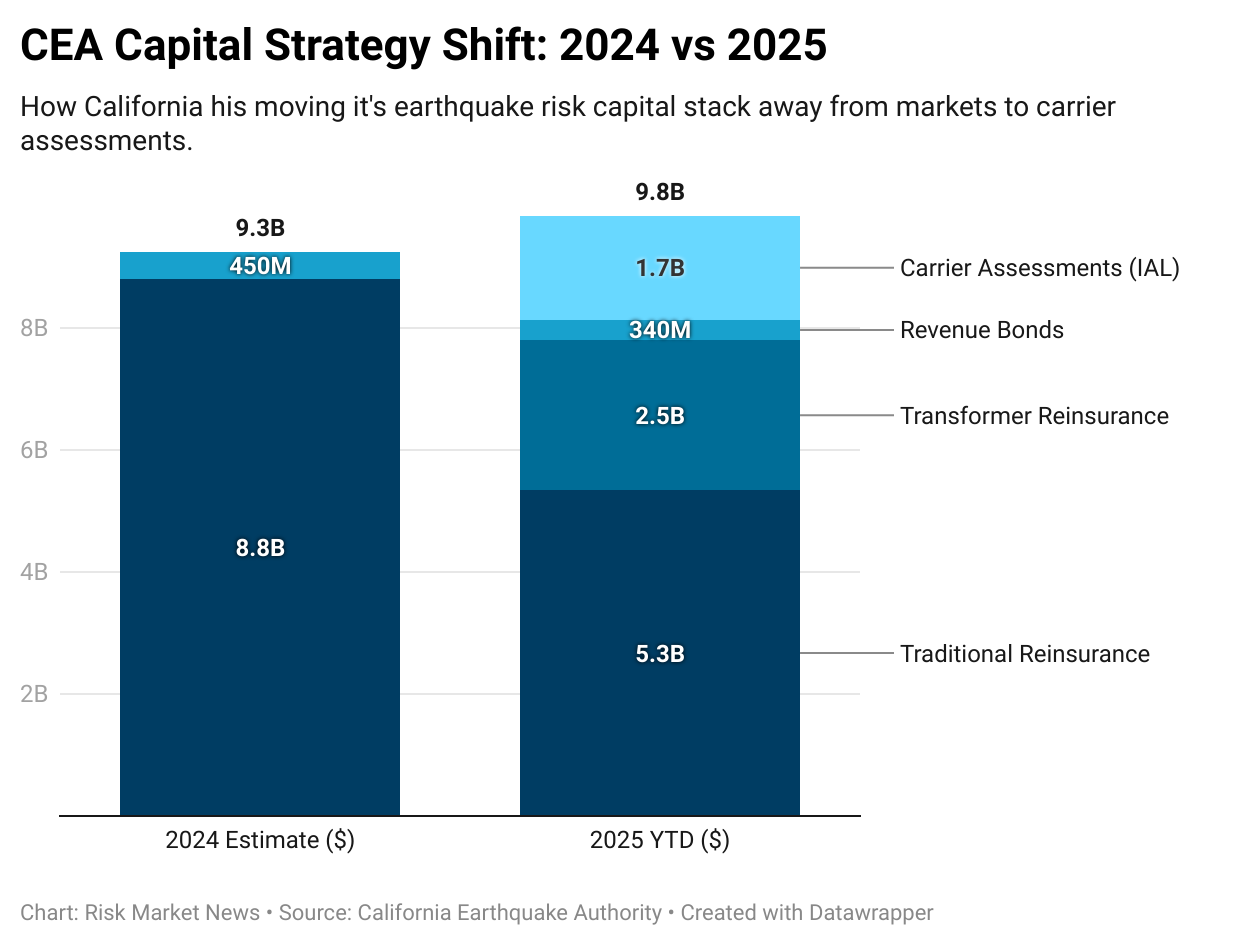

A quiet but significant shift in capital strategy by the California Earthquake Authority (CEA) is drawing growing criticism from some of the state’s largest homeowners insurers, who say the quasi-public agency is leaning too heavily on carrier-backed assessments while pulling back from traditional reinsurance and bond financing.

At the center of the debate is the CEA’s decision to preserve the Industry Assessment Layer (IAL)—a top-tier $1.7 billion capital buffer funded not through markets, but through assessments on participating insurers. Originally designed in 2008 as a temporary, contingent risk layer, the IAL is being maintained through short-term revenue bond issuances, enabling the CEA to delay or reduce reliance on external reinsurance purchases.

“We view these actions as a bit inconsistent with the spirit of the multi-party stakeholder negotiations from 2008,” said Jeff Huebner, Chief Risk Officer at CSAA Insurance Group, in earlier public comments at the March 2025 Advisory Panel meeting. “We think the layer was intended to be temporary, and it's feeling a little less temporary with repeated issuances of revenue bonds.”

A Shift in Capital Mix

According to financial disclosures presented at the CEA’s June 2025 Advisory Panel meeting, the agency’s total risk-transfer program has fallen to $7.8 billion year-to-date, a notable reduction from prior years. At the same time, CEA has: