Thanks for subscribing to the free version of Risk Market News.

Consider becoming a paid subscriber to RMN for access to weekday editions.

NFIP Drowning In Repetitive Losses

Despite pouring billions into the “mitigation” of flood prone properties throughout the U.S. for 30 years, the government program has failed to slow the speed National Flood Program’s (NFIP) fiscal collapse.

According to a report from the U.S. General Accounting Office (GAO) issued last week, although the US government has demolished, moved or flood proofed over 50,000 properties since the mitigation program’s launch in 1989 the NFIP remains in threat of continued insolvency. According to the report:

While these efforts can reduce flood risk and claim payments, the federal government’s fiscal exposure from NFIP remains high because premium rates do not fully reflect the flood risk of its insured properties.

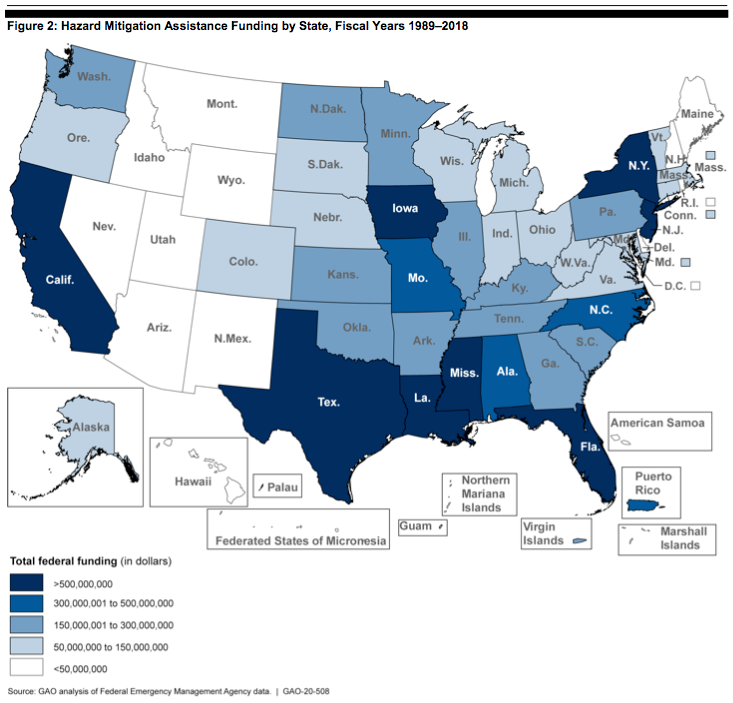

According to the report, the estimated annual funding for mitigation programs averaged $300 million to $500 million per year over the program’s lifetime. The amount is higher in flood prone years. Government officials said that it spent over $2.3 billion in mitigation projects from 2014 through 2018 alone.

Mitigation efforts fall into four categories: acquisition and demolition; acquisition and relocation; elevation and flood proofing. Mitigation efforts vary by state [see chart above], and the GAO said that property acquisition accounted for about 80 percent of mitigated properties nationwide.

Although there is a long history and enormous budget dedicated to mitigation, the report says that has not moved the needle on the NFIP’s overall financial health.

The authors add in spite of three decades of investment, mitigation has not kept pace with increased flood risk and the number of homes that experience numerous, successive floods that are considered a “repetitive loss.” The study said that the number of repetitive loss properties outpaced mitigation efforts every year, adding that from 2009 through 2018, the Federal Emergency Management Association’s (FEMA) inventory of new repetitive loss (RL) properties grew by 64,101.

The report concluded

Because several categories of NFIP premium rates do not reflect the full risk of flood loss, FEMA has had to borrow $36.5 billion from Treasury to pay claims from several catastrophic flood events since 2005. To address this, some have suggested additional funding to mitigate [repetitive loss] properties. While we acknowledge that mitigation is part of the solution, we maintain that a more comprehensive approach is necessary to address the program’s fiscal exposure.

PG&E Wildfire Settlement Is a Dumpster Fire

If you are a attorney, investment bank, hedge fund or insurer, last week’s approval of Pacific Gas & Electric (PG&E) bankruptcy plan was a big win. If you are a homeowner or business located in the quickly growing regions of the United States at risk of wildfires, it’s a warning shot.

A federal judge approved a $58 billion plan by the nation’s largest utility to settle claims for 2017 and 2018 wildfires that killed more than 100 people wiped out entire towns. The plan limits liability for many of the financial backers of PG&E, while not addressing the underlying and continued risk.

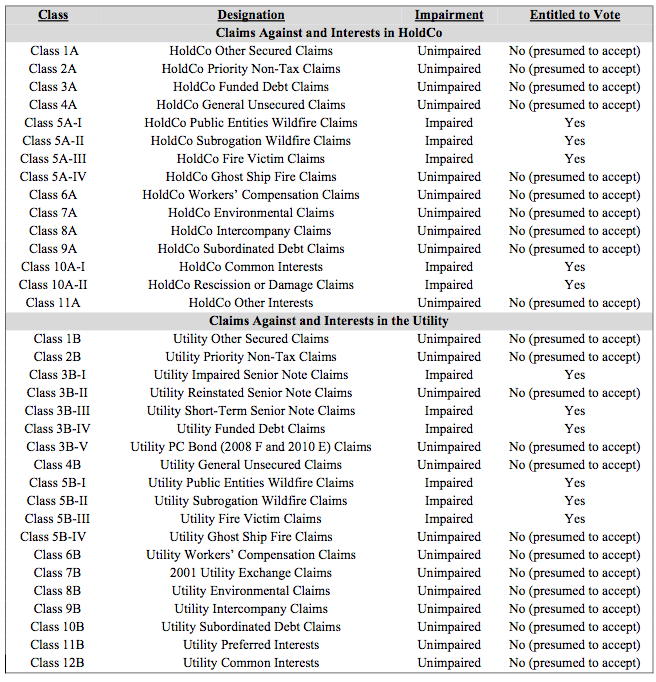

First, as bankruptcy newsletter Petition points out the reorganization plan proposed and then finally approved stands out for its very generous view of debt holders (banks, hedge funds, corporate bond holders) and its not so generous position on wildfire victims.

In a nutshell, the plan impairs all wildfire claimants and common interest holders and rides everyone else through.

The utility move quickly to fund the settlement by offering $9 billion in equity — one the year’s largest stock sales — to help pay for claims from wildfires.. The company has also raised more than $13 billion in the debt markets to finance its bankruptcy.

Vulture investors, such as Baupost Group, also made out by purchasing $2.5 billion in PG&E wildfire insurance claims at a discount and almost doubling their investment as part of the settlement.

Hong Kong Clears Legal Hurdle for ILS Market

The legal arm Hong Kong’s treasury has cleared the path for legislation that would make it easier to launch captives and insurance-linked securities (ILS) vehicles and pull business from London and offshore centers.

A review by legal arm of Hong Kong’s Financial Services and the Treasury Bureau (FSTB) issued last week said that four red flags brought up by officials should not slow the adoption of new legislation.

According to the legal review:

- ILS products which fall within the definition of "securities" and are subject to regulation by Hong Kong’s Securities and Futures Commission.

- Setting up a special purpose insurer to run the ILS vehicle would not require Hong Kong’s Insurance Authority to approve “key persons” in control, and ILS structures would only be required to appoint a an administrator.

- The Hong Kong Insurance Authority would, however, will be able to sanction ILS firms that violate regulations. According to the Legislative Council’s attorney’s:

given the nature of the underlying risk of investing in ILS and the potential loss of investment upon the occurrence of a predefined trigger event, ILS are not considered to be financial products suitable for ordinary retail investors. To provide deterrent effect for the protection of ordinary retail investors, FSTB considers it necessary to empower IA to prescribe offences for contravention of rules on sale restrictions of ILS”

Hong Kong has moved quickly to push legislation that would help the region compete for ILS.. A bill was introduced in March that provides for a custom, streamlined regulatory framework for the issuance of ILS in Hong Kong through a special purpose vehicle (SPV).

Lemonade to Investors: Does This S-1 Make Me Look Young?

Insurtech darling Lemonade is on the final legs of its initial public offering and by issuing its S-1 last week. The company plans to raise $270 billion by offering shares at a range of $23 to $26 , valuing the company at $1.4 billion.

Lemonade has raised about $480 million privately, with a $300 million Series D led by SoftBank. That values the company at $42.21, so its proposed IPO price of represents a 42% discount to that round on a per-share basis. Earlier investors are getting a better deal, with firms like General Catalyst having valued the company at $13.80 per share in a 2018 round, allowing them realize a 78% gain.

Never the less, a good chuck of investors will experience a “down round” on the Lemonade IPO, with firms like Baillie Gifford planning to take down $100 million of the IPO, a cut of 37%.

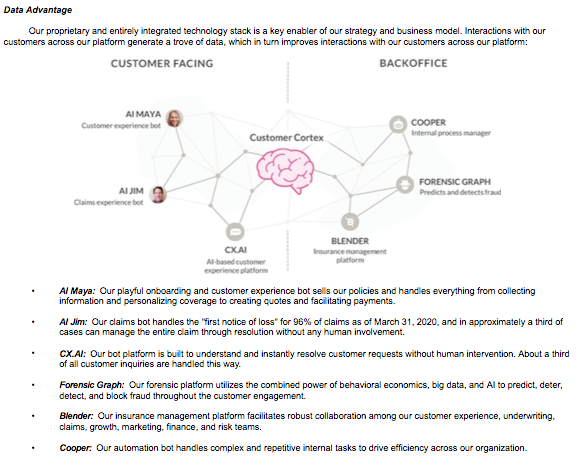

Nonetheless, management and bankers put their best foot forward on the offering document, arguing that its “direct, digital, customer-centric experience” will differentiate from older insurance competitors through the use of “bots” “AI” and “forensic graphs.”

Certification Remains a TRIA Sore Spot

Seven years after the Boston Marathon Bombing publicly revealed problems with the Terrorism Risk Insurance Act (TRIA) certification process, insurers are pushing Congress overhaul government approvals as part of TRIA’s annual review.

Comments from private market on TRIA, which expires in September, were released last week.

Lloyd’s of London said in a comment letter that TRIA certification remains a sticking point in an otherwise well functioning program.

The current certification rules, promulgated by Treasury in accordance with the 2015 reauthorization legislation, do help give insurers and policyholders a sense of the timeline for potential certification of an event. However, due to the Secretary’s unreviewable discretion in certifying an act, it remains problematic that Treasury could rule out even considering an event for certification, but insurers and policyholders would have no way of knowing it.

Lloyd’s said that TRIA should be revised so that insurers or policyholders could petition Treasury to review an event for certification rather than wait for a decision that may never come.

The certification process is even more uncertain when it comes to a TRIA covered loss related to a cyber catastrophe, according to a comment from the Reinsurance Association of America.

The certification process under TRIP also poses issues given the difficulties arising out of attribution of cyber-related losses. These issues should be studied in relation to how they impact TRIP coverage and the evolving cyber market. Possible areas of study could include: (1) types of economic losses associated with cyber operations; (2) how problems with attribution and intent could impact certification, including for events occurring outside of the U.S. that impact U.S. citizens and companies; (3) definitions of cyber liability and insured losses; (4) impact of war exclusions on cyber coverage.

A recent report by the General Accounting Office said that the lack of timely certification information is negatively affecting the speed with which insurers respond to policyholder claims.

TRIA is set to expire December 31, 2027.