Pummeled By Nature, Tonga Now Faces Financial Catastrophe

As Tonga attempts to rebuild from its latest natural catastrophe, China will play an outsized role in the country averting financial catastrophe.

The Pacific island nation of Tonga was already on the financial edge as the world entered the New Year, shunned by most Western banks and insurers and considered a “high” risk of debt distress by the International Monetary Fund (IMF).

But the catastrophic eruption of the Hunga Tonga-Hunga Ha‘apai undersea volcano on January 14 brings into question the myriad internal debt financing arrangements that already burdened the island nation, often drawn to rebuild after previous natural catastrophe events.

But perhaps the biggest question mark is related to China, which owns what policymakers describe as huge “off-the-radar” Tongan debt.

In a 2020 report the IMF said that Tonga’s debt load would likely overtake economic solvency thresholds by the end of the decade given current trends, but the report noted that could happen much sooner given the country’s exposure to natural catastrophes.

Given that the Tonga is facing what is thought to be the largest volcanic event in 30 years, it’s more than likely that it will face the threat of default on its massive debt without international intervention.

The finances of all small island states in the Pacific have been hit by the global COVID-19 pandemic over the past two years. The average debt-to-GDP ratio in the region is hitting 49%, according to a report by the Organisation for Economic Co-operation and Development (OECD).

But Tonga’s economy has been particularly beset by catastrophic external forces that have crippled its economy. As recently as February 2018, Category 4 Tropical Cyclone Gita struck the country in an event that impacted nearly 50% of its population, destroyed 1,200 homes and caused damage estimated at $61.7 million.

But the picture of how dire is Tonga’s financial situation following the January volcano may is made even muddier by what the OECD describes as Tonga’s “off- the-radar” debt owned by China.

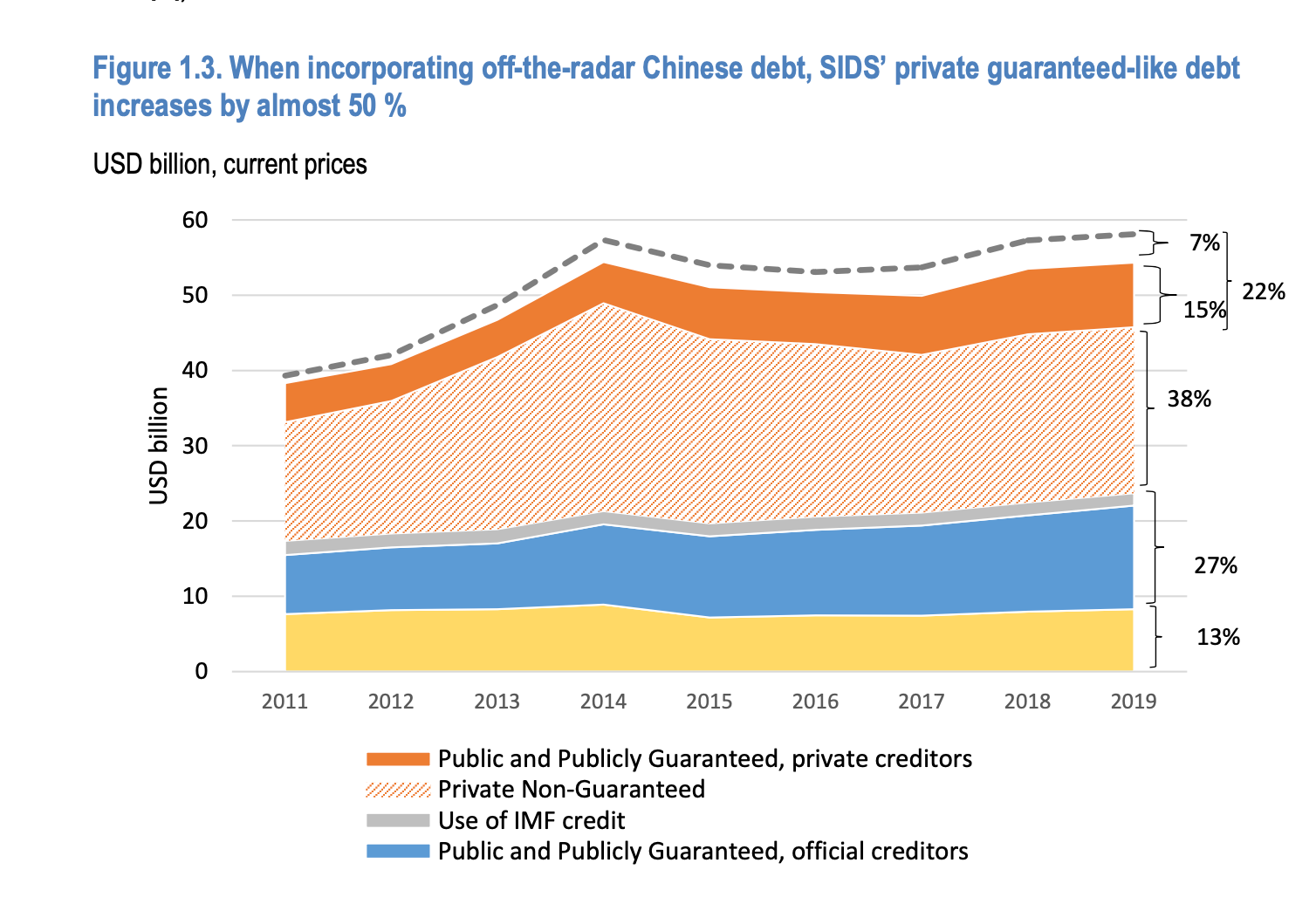

As the OECD report points out, China has been funneling development debt into Pacific island nations for years and Chinese debt is estimated to add an extra $3.8 billion, on average, or 7% of all the island nation’s total external debt.

This report observes a large heterogeneity of situations across SIDS, in particular with regard dependence vis-à-vis Chinese lenders, and suggests that liquidity problems could turn into solvency problems if no actions were taken.

The IMF reports that Tonga's half of Tonga's total public debt is to China, with a sharp spike in debt repayments due from FY2024 onwards.

The present value of the public debt-to-GDP ratio is expected to breach the benchmark starting from FY2029 under the baseline scenario. A tailored one-time natural disaster shock would imply a significant deterioration in debt sustainability.

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.