Q&A: Munich Re’s Caoimhe Adams

The head of Climate Change Solutions at Munich Re says the nature of catastrophic losses are changing and the reinsure's approach to modeling is responding.

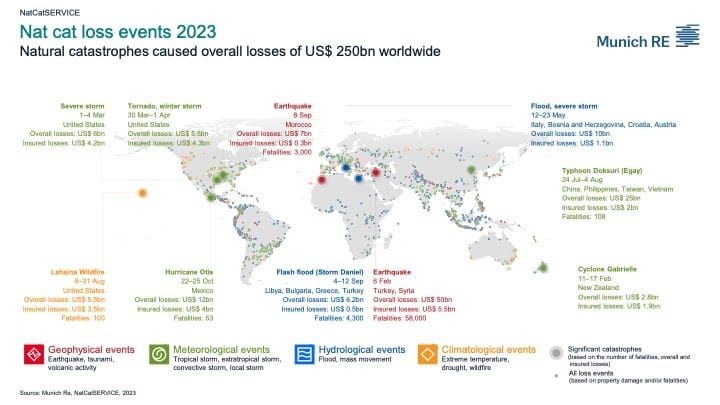

Last week global reinsurer Munich Re NatCatSERVICE released its annual natural catastrophe report saying 2023 was another year of record insured and non-insured losses. However, those losses were produced with fewer headline grabbing extreme events.

While large catastrophes like the Turkey/Syria 7.8 magnitude earthquake produced a humanitarian disaster with 58,000 people killed and a collapsed regional infrastructure, it was the constant drumbeat smaller but more intense thunderstorms in developed countries like the US that produced the vast majority of the $95 billion in in insured losses.

This week RMN had an email discusses with Munich Re’s Caoimhe Adams regarding 2023 catastrophe losses and the implications for the reinsurer’s approach to risk modeling.

Caoimhe Adams was appointed Munich Re’s head of Climate Change Solutions in January 2023. As a qualified actuary, Caoimhe brings her analytical strengths and personal interest to drive the climate topic within Munich Re. Her team is responsible for developing climate-related business solutions including data services and advisory within reinsurance development.

Risk Market News: The report states that such high thunderstorm losses have never been recorded before in the USA or in Europe. What’s driving the losses in particular?

Caoimhe Adams: Insured thunderstorm losses in North America this year reached a whopping US$ 50bn – that’s double the losses we saw in 2022 and more than double the 10-year average. Likewise, Europe saw a large jump with a more than 30% increase from 2022 and an almost tripling of the 10-year average.

Taken all together, there are three factors that make up the primary loss drivers: hazard, exposure and vulnerability:

- According to the latest science, climate change can have an impact on the frequency and/or severity of severe thunderstorms in many regions around the world. This is what we call the “hazard”. Warmer air can hold more moisture (about 7% more per 1.8°F (1°C) of warming). This in turn creates more energy to potentially fuel more and stronger thunderstorms.

- The second factor is where a severe thunderstorm occurs. Is the area densely populated or not? This is the “exposure”.

- On the other side of the equation, we have the third factor, “vulnerability” (e.g., building codes, early warning systems, etc.). Improving the resilience of a given location can help to drive down losses.

RMN: What are the hurdles to modeling severe convective storms?

Adams: There are two main hurdles to modeling these kind of storms:

- Severe thunderstorms and the associated hazards – such as large hail, heavy squalls, heavy precipitation and tornadoes – are very localized phenomena. For example, hail can strike one house, but not the one next door. There are still many unanswered questions in science as to how exactly large hailstones or tornadoes form, impacting how they can be modeled. Representative simulations and complex statistical models are necessary to better understand these small-scale phenomena.

- Data reliability varies depending on the hazard itself. For example, lightning data can be collected automatically with sensors resulting in a highly comprehensive dataset. But hail, on the other hand, cannot be detected automatically. In these cases, we have to rely on available observational data, which are inherently lacking in homogeneity, completeness and quality.

And while accurately modeling natural hazards relies heavily on data, our industry has to equally rely on experience and knowledge of experts. This is why at Munich Re, we have a breadth of scientists (meteorologists, climatologists, geographers) working intensely on these topics.

RMN: Deaths from geophysical hazards jumped in 2022. Was this the result of the February series? What lessons did Munich Re take from that event in terms of data and forecasting?

Fatalities from natural hazards jumped from 11,000 in 2022 to 74,000 in 2023. This can be largely attributed to the devastating earthquakes in Turkey and Syria back in February where 58,000 people lost their lives. This tragic event underscores the importance of having hazard-adequate and strictly enforced building codes.

RMN: Given the influence of rising global temperature cited in the report, how is Munich Re calibrating its modeling to account for its influence on losses and event models?

Adams: Munich Re’s risk models are designed in such a way that they take into account the effects of climate change to date (depending on the peril and the region), reflecting the current risk to the utmost extent possible.

NOAA has already stated that as of today, temperatures stand at around 1.3 degrees centigrade above pre-industrial times. This temperature difference does not, however, impact the world evenly. Those in higher geographical latitudes have experienced a greater temperature difference than those in equatorial regions. Depending on the approach taken to keep temperatures in line with the 2015 Paris Agreement, there are a number of climate scenarios that could play out. But the bottom line is that higher temperatures impact weather-related natural catastrophes in frequency and/or severity differently depending on the peril and the location. Our models take this into account.

RMN: The report cites the unusual rapid intensification of Hurricane Otis in October. How do you need to adapt to the rapid intensification phenomena in modeling outcomes?

Adams: According to the IPCC, the frequency of such rapid intensification events has indeed likely increased and will also possibly continue to do so. As we start to see more and more of events, the hazard component in our modelling is adjusted accordingly.

Hurricane Otis developed from a weak tropical storm to the highest-category hurricane within twenty-four hours. The poor predictability of a rapid intensifying hurricane could increase losses by catching communities off-guard and resulting in significantly shorter warning time for the affected areas. This is why it's so important that communities proactively take measures to increase their resilience now and into the future.

RMN: What are Munich Re’s catastrophe modeling, data and forecasting priorities in 2024?

Adams: Traditionally, the insurance industry has focused on modeling peak perils like hurricanes, earthquakes and winter storms. That’s because when a strong hurricane, for example, strikes a heavily populated area in the US, the industry faces large losses. We saw this in 2022 with Hurricane Ian, which resulted in insured losses of US$ 60bn. In 2023, while we didn’t have such a significant single insured loss event of that magnitude, what we did have were severe thunderstorms losses that – in aggregate – reached close to that of Hurricane Ian.

Thunderstorms were once considered non-peak or secondary perils, but these are now coming increasing into focus. At Munich Re, we have already been investing in building out our internal models for non-peak perils for a long time. And we will continue to prioritize building both peak and non-peak perils modeling into the coming year and beyond.

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.