Small But Active Offshore Reinsurers Marching Against Tax Rule

The reinsurance industry has lined up against the Internal Revenue Service's latest salvo against hedge and private equity fund-backed reinsurers that would target their tax treatment.

Thanks for subscribing to the free version of Risk Market News.

Below are some other stories that RMN premium subscribers are read this week.

TWIA Mulling Model, Broker Revamp

Bank Climate Model “Data Gaps” Requires Investment: BIS

Catastrophe Q&A: Researcher: Colorado State University’s Phil Klotzbach, Part 1 (Available to non-subscribers)

Catastrophe Q&A: Researcher: Colorado State University’s Phil Klotzbach, Part 1

Fund Risk Bets: KKR, American Financial Group

Insurance Investment Pros Say Climate's Important, But Have You Seen My Fixed Income Yields?

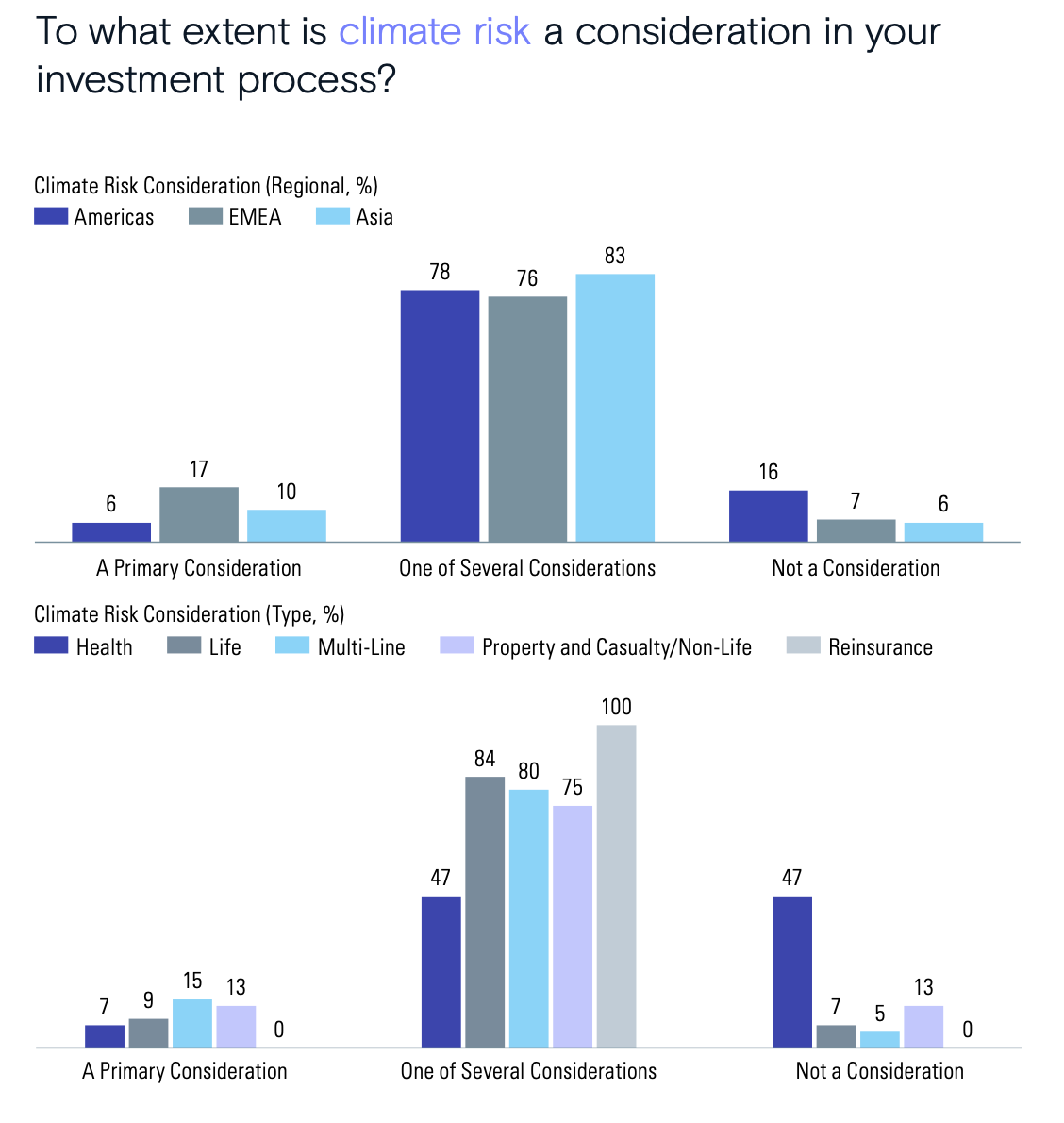

Despite rising losses and dire warnings from the insurance industry that climate change is pressuring their underlying business models, a vast majority of insurer investment professionals don't consider climate risk a "primary" concern in their portfolio decisions.

According to the survey release last week by Goldman Sachs Asset Managment (GSAM), only 13% of property/casualty insurers and 15% of multiline insurers consider climate a primary consideration. Most surprising the sector arguably most at risk f0r climate risks – reinsurers - report that no investment professionals considered it a primary risk.

Goldman points out that despite climate no being a primary driver of reinsurance company investment decisions, 100 percent of reinsurers that responded to the survey said that it as part of their investment process – highest of all the sectors.

The biggest risk for insurance CIOs in 2021 is the threat of low yields, which GSAM points out "represents a sharp reversal from 2019 where insurers cited deteriorating credit quality as their top investment risk."

Flood Correlation is Capital Causation

Analysts from the Bank of England say that insurers need to rethink their risk model assumptions as "wet years" become more frequent in the UK.

According to an article from the BoE, only a few UK insurers' figure in major windstorms to co-occur"with inland floods during the winter season and are those coexisting risks are "underrepresented" in the insurers's model assumptions.

Not having the correct model assumptions in their modeling could have a direct impact on the insurers bottom line, with the BoE analyts saying that the lack of can have a material impact on an insurer’s capitalization.

Our test case showed that the neglected correlation might plausibly result in a low single digit underestimation of insurers’ capital allowance. This is not alarming by itself but indicates that an aggregation of underrepresented correlations could raise risk management concerns – if not capital ones.

Risk Reads

A new forecasting model suggests an uptick in the frequency of magnitude 4 earthquakes along certain faults can predict large earthquake events of magnitude 6.7 or larger.

Magnitude 4 earthquake rates may forecast larger future earthquakes (UPI)

[In] the face of the unsustainable debt burdens that continue to plague the Caribbean, it is crucial to remain suspicious of the purported benefits that state-contingent debt instruments or other insurance-based mechanisms are advertised to offer. Countless debt solutions, even disaster-related debt restructurings like temporary suspension or interest rate forgiveness schemes that are seemingly unavoidable to agree to, are driven by the same economic logics and geopolitical entities that generated many of the region’s ruinous debt burdens in the first place.

A federal bankruptcy judge on Tuesday refused to relinquish jurisdiction over an insurance-related dispute that could net up to $400 million or more for victims of wildfires likely caused by Pacific Gas and Electric’s equipment. Retired Justice John K. Trotter of California’s Fourth Appellate District runs a multibillion-dollar trust established as part of a plan to bring PG&E out of Chapter 11 bankruptcy last year. In February, Trotter sued 22 former PG&E board members and executives in state court on claims of breach of fiduciary duty. PG&E assigned its right to pursue those claims to the Fire Victim Trust as part of a settlement agreement reached last year.

Wildfire Victims Lose Bid to Send PG&E Insurance Dispute to State Court, Courthouse News Service

In my Budget this year, I announced a two-year pilot programme to attract companies to issue insurance-linked securities in Hong Kong by subsidising their upfront costs. That's subject to a cap of about US$1.5 million per issuance, depending on the maturity of the securities. We are also working with Mainland authorities to establish Hong Kong after-sales insurance service centres in Greater Bay Area cities. That would give Hong Kong, Macao and Mainland residents holding Hong Kong-issued insurance policies the comprehensive support they deserve.