Thanks for reading the free Sunday edition. Here are some subscriber only posts you missed:

Texas Goes Out to Bid Again for Cat Model Review: TWIA seeks a firm to validate its models as it receives rate hike pushback.

US Needs to “Dramatically” Advance Weather Models, Government Report: The federal government needs to overhaul is approach to weather forecasting if its to meet increased catastrophe losses.

California Renews RMS, Says New Fault Research Won't Change Risk: A web of faults and fault ruptures discovered following the Ridgecrest quake is not a "short-term" risk.

Consider subscriber for full access to all posts.

Consumer Groups Burn California Fire Models

As modeling moves beyond traditional risks like windstorm and earthquakes into new areas like wildfire, so is the pushback from communities and political leaders.

Politico's Debra Kahn has a story in Politico on the push by the insurance industry to apply wildfire models to ratemaking in California and the political and consumer backlash. The less-than empathic industry view:

"People don't want to admit that the risk is going up and that in order to be resilient, they have to change how they're doing things," said Nancy Watkins, a consultant with the firm Milliman who analyzes risks for insurance companies.

And the consumer pushback, including encouraging the California insurance commissioner or reject the proposal:

"To give them carte blanche to raise rates because they have some actuary that justifies it is not consumer protection," said Jamie Court, president of Consumer Watchdog, the group that wrote a 1988 law that made the state’s insurance regulator an elected position and gave it authority over rates. "The companies want to be able to get whatever rates they want based on this catastrophic modeling, and that's not what Prop. 103's about."

Below are some of what RMN has written on the issue over the past year:

Model Proposal Sparks California Wildfire Battle

Firms Make Pitch for California Wildfire Model Adoption

Despite Catastrophes (and ROE), Investors Pour Money Into Carriers

Insurers made it out of 2021 pretty well positioned, at least when it comes to investors.

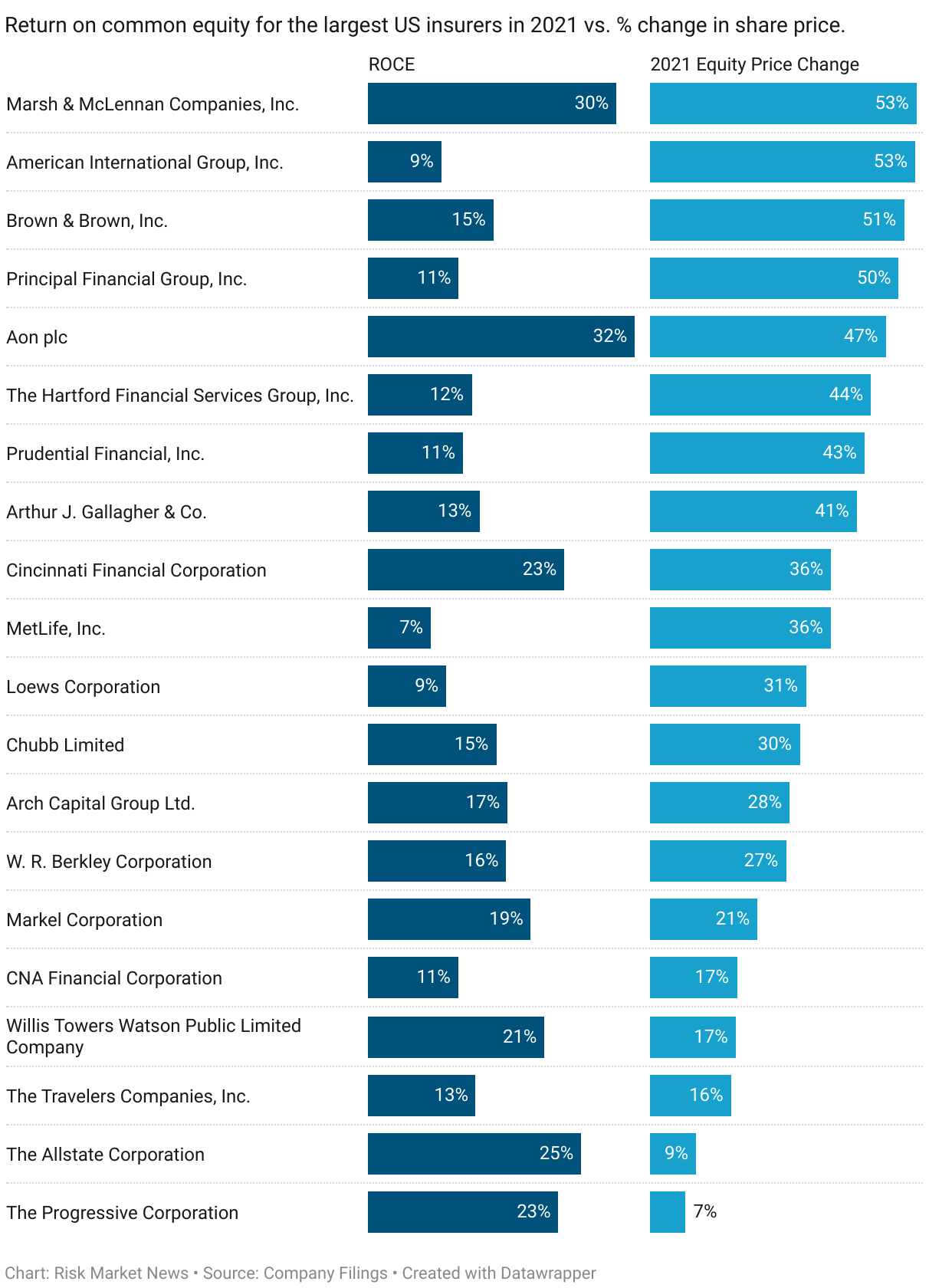

Despite the rising number of billion dollar catastrophe losses, shares in US insurers continued to rise in 2021 as the broader equities markets continued their post COVID tear.

The average price change of 153 US publicly traded insurance stocks in 2021 was 11.70%. The median percentage change for the same set of equities was 6.84% during the same period.

Generating shareholder value was less successful last year as return on common equity with average ROCE for US insurers' coming in at -9.78. although as the chart below shows the largest publicly traded insurers were able to hit double digit numbers with the vast majority trailing the share gains.

Modeling Climate"Overshoot"

Climate modeling researchers have issued their opinion of the growing conensus among climate policymakers to "overshoot" the Paris Agreement's temperature carbon emission goals and then makeup it up on the backend.

The math doesn't work out.

According to the research published in Science, both the mitigation costs of carbon recapture and the economic losses of rising temperatures would wipe out any benefit and actually lead an increase in risk for the long-term.

Limiting temperature overshoot by anticipating mitigation efforts leads to a stream of climate change benefits, cuts the right tail of the distribution of different impact indicators and eventually lowers mitigation costs. All these benefits accrue during the second half of the century. Therefore, the choice of the discount rate, as well as preferences over these extreme risks, determine whether overshooting can be considered as a viable option or not.