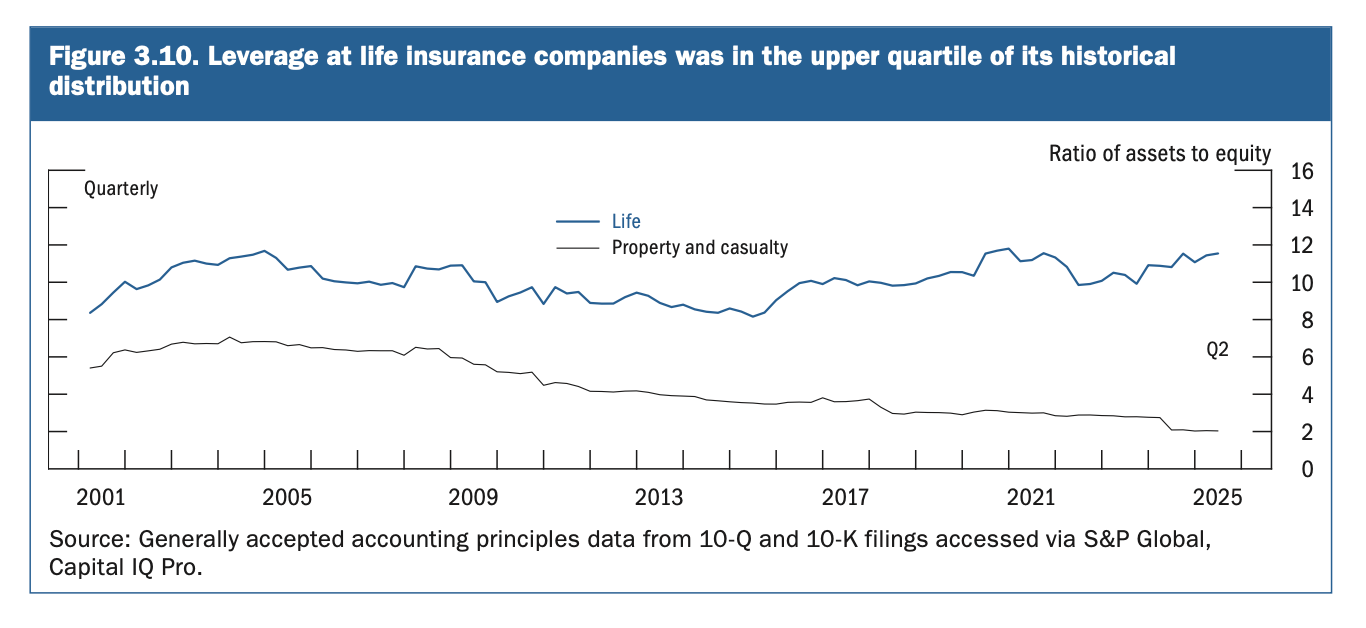

Life insurers are carrying more leverage than they have in years, according to the Federal Reserve. However, industry executives argue that the risks are measured and kept in check.

The Fed’s latest Financial Stability Report, released last week, said the sector’s leverage “remained in the upper quartile of its historical distribution” through the first half of 2025. The report also warned that vulnerabilities tied to leverage across nonbank financial institutions, including insurers, “remain notable.”\

The finding has drawn attention because it comes as life insurers expand further into private credit and structured assets—markets that have grown rapidly on the back of rising annuity and funded-reinsurance flows.

The Fed report joins a growing chorus of concerns about the life industry’s embrace of private credit, including a recent Bank for International Settlements paper that warned the sector could face a “doom loop,” and comments from S&P Global Ratings’ Carmi Margalit, who said that while private-credit risks are manageable, they add significant complexity.

Despite those warnings, judging by recent earnings calls from the industry’s largest players, executives are signaling confidence in their balance sheets and in the risk-management discipline underpinning their credit strategies.

At MetLife, Chief Investment Officer Chuck Davis told analysts the company’s private-credit business remains anchored in in-house underwriting rather than external ratings. “We’re a top-tier private-asset, private-credit manager,” he said, emphasizing that “95% of our corporate bonds are investment-grade.” Chief Financial Officer John McCallion added that credit spreads were “priced for perfection” and that MetLife continues to steer “up in quality,” reflecting a cautious stance toward yield-driven risk-taking.

Lincoln National offered a similar defense of its approach, even as it rebuilds capital after several years of balance-sheet restructuring. CFO Christopher Neczypor said the company’s financial leverage “is back to its 25 percent target,” describing Lincoln’s capital position as “well above” required buffers. He framed the company’s investment strategy as deliberate rather than opportunistic: “Within private credit, we remain comfortable and confident in our long-standing disciplined approach and continue to lean into investment-grade private and structured strategies.”

When pressed by analysts about recent headlines in private credit, Neczypor distanced Lincoln from the riskier end of the market. “We don’t really have exposure or an impact from the names in the headlines,” he said, adding that Lincoln had historically been “somewhat under-allocated” to private credit compared with peers. “We feel really comfortable with our portfolio… credit quality is very stable… credit losses very de minimis.”

Both firms underscored “capital efficiency” and “risk-adjusted returns” as priorities while maintaining dividend capacity and regulatory capital targets.

“We continue to manage capital with discipline, protecting liquidity and balance-sheet strength while returning excess capital to shareholders,” McCallion told analysts.