When Travelers Companies reported earnings last week Chairman CEO Alan Schnitzer was anxious to point out that their stellar 2023 would have been even better, with more consistent performance... if it were not for their personal lines insurance performance and its associated catastrophe losses.

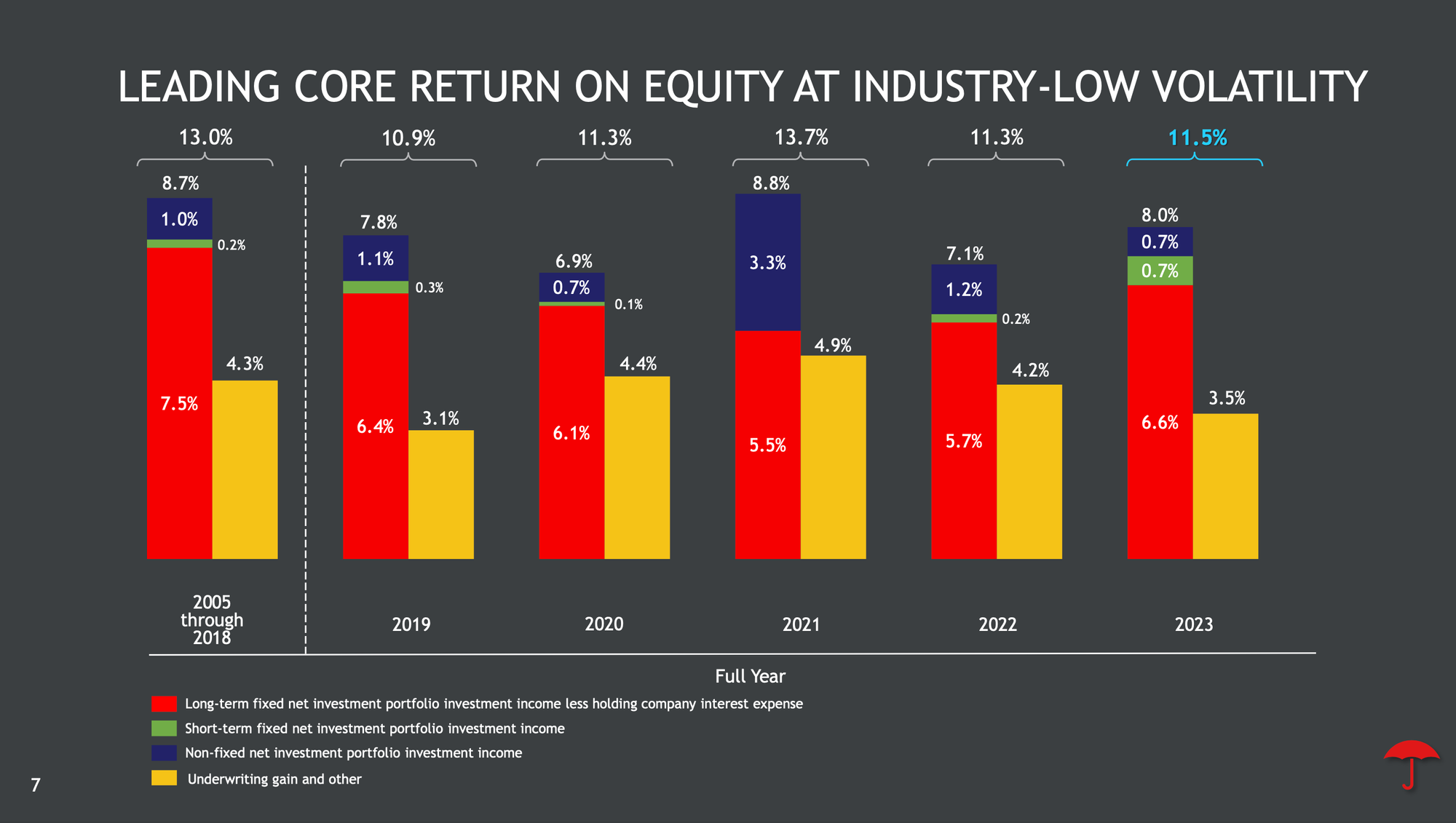

"We are pleased to have delivered full year core income of $3.1 billion, generating core return on equity of 11.5%," he told investors. "Notwithstanding elevated industry-wide catastrophe losses earlier in the year and a personal lines operating environment that, while improving, was difficult during the year."

A top ten property/casualty underwriter in the US by both market share and premium, Travelers reported that its fourth-quarter profit more than doubled as the company saw its core income rise to $1.63 billion from $810 million a year ago.

Profits were fueled by Travelers going hard after the business insurance segment, a mix of bond, specialty and excess/surplus (E&S) lines. Executives said they added more than $4 billion in business insurance premium to their top line over the past two years.

But it was catastrophe losses and their impact on the bottom line that Schnitzer and other executives said prevented Travelers from making even larger gains in 2023. And this was despite a "modest" $125 million in pretax catastrophe loss in the fourth quarter and what executives said were no "individually significant events" impacting their book of business during the period.

The fact that Travelers' financial performance continues to be weighed down by personal lines weather and natural disaster losses despite the lack of significant catastrophes within the US in 2023 is not a surprise to industry watcher who say the so-called "secondary perils", including severe convective storms, are becoming the most significant loss driver for insurers and a bigger challenge for modelers.

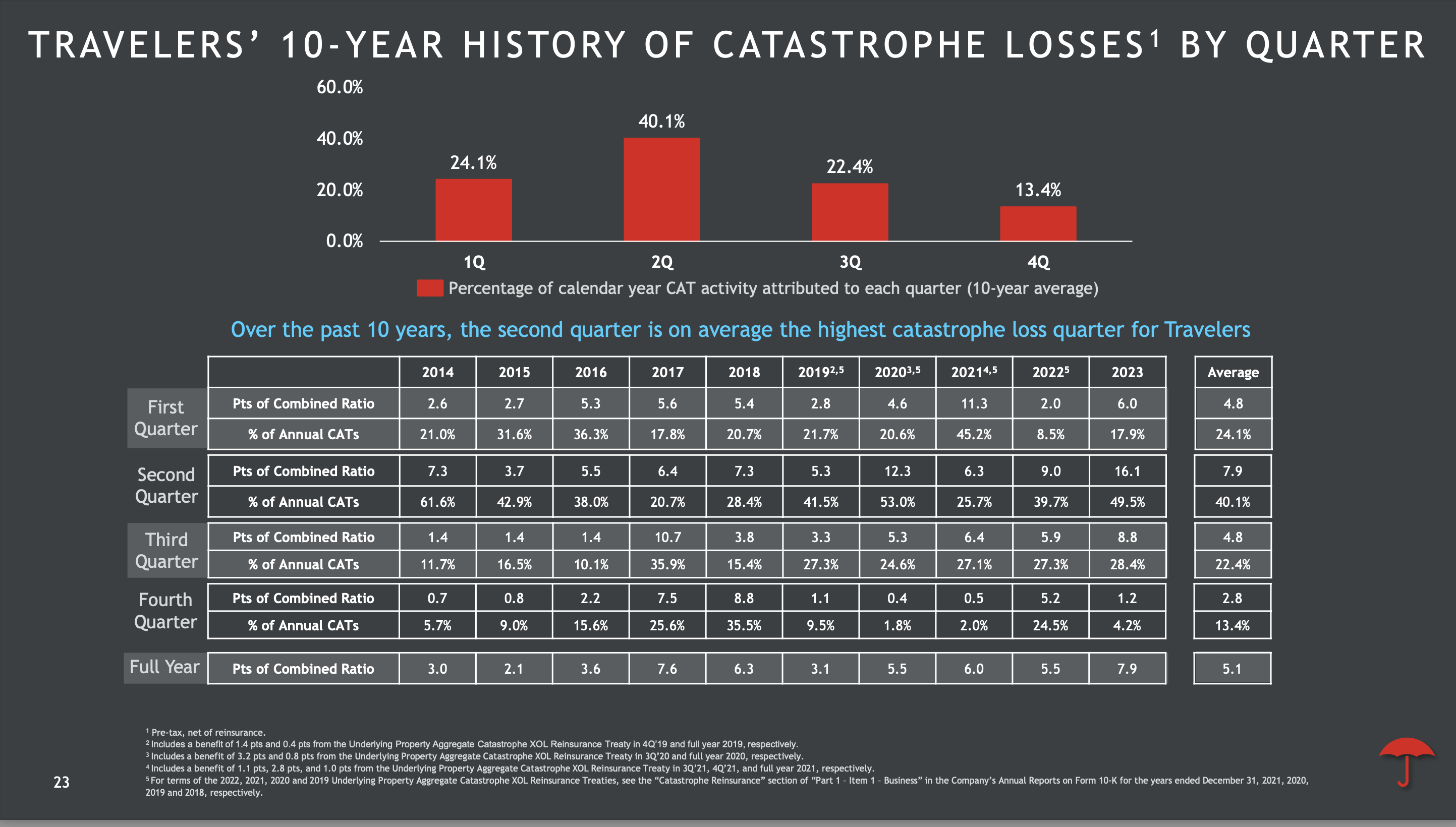

Travelers executives, in an effort to drive home the point, warned investor to expect even more volatility and losses since catastrophes were most pronounced in the second quarter when tornados and severe thunderstorms menace the middle and southeast US.

"Cat losses in the second quarter had been, on average, more than three combined ratio points higher than in any other quarter," said CFO Daniel Frey during the earnings call. "And the second quarter has been our largest cat quarter in seven of the past 10 years."

Investors may need to change their pespectives on inanancial performance and expect higher and changing "seasonal volotolty" for US insuers, the Travelers Schnitzer said, adding that includes return on equity expectations.

"I won't tell you would do, but one of the things I do every quarter is try to take a stab at normalizing these things," told one analyst on Friday's earnings call. "And so eliminate prior year development and put in for cats, whatever you think is a normalized cat number and then you get a different perspective."

RMN this week

Thanks for subscribing to the free Sunday newsletter version of RMN. Below are some of the stories that weekday subscribers were able to access.

Updated USGS Quake Model Includes “Substantial” Changes

Insurers Sees Opportunity In “Basel Endgame” 🔏

Become a premium subscriber to RMN to access all content

Risk Reads

Hedge Funds Rake in Huge Profits Betting on Catastrophe Risk, Bloomberg

The best hedge fund strategy of 2023 was a bet on insurance-linked securities (of which catastrophe bonds are the dominant sub-category), which generated over 14%, according to Preqin, a consultancy that provides data on the alternative asset management industry. Preqin’s benchmark return for the industry — across strategies — was 8%. That compares with a 19.7% gain in the Swiss Re Global Cat Bond Performance Index Total Return.

Clusters of atmospheric rivers amp up California storm damages, Stanford News

“When I started this work, I was expecting the losses to be 10 or 20% higher for atmospheric rivers occurring in a sequence, but the losses are tripled or quadrupled,” said lead study author Corinne Bowers, PhD ’23, who worked on the study as part of her doctoral thesis as a student in Baker’s lab

Reinsurers pull back from Israel and Middle East risks, Financial Times

The get-out clauses were inserted into some contracts drawn up with insurers as part of turn-of-the-year policy renegotiations, four market participants told the Financial Times. Such clauses were entirely new and had not been used before, two of them said. If triggered, this would mean that the insurer would not from that point have reinsurance coverage for any newly underwritten premises or other asset — such as, for example, a commercial building damaged by a rocket attack. The increased risk would then likely be passed on to the client in the form of higher premiums or reduced coverage.

Extreme Weather Events and Climate Change: Economic Impacts and Adaptation Policies, SSRN

Wider availability of high-resolution hazards data and advances in remote sensing have improved how we model exposure and, to some extent, vulnerability to natural hazards. However, more systematic collection of spatially referenced high-frequency household (and firm) surveys which include questions specific to the impacts of climate extremes would enable further study of their distributional implications (across space, economic sectors, and income groups) and, especially, their impacts on the poor, which are underrepresented in macroeconomic indicators such as GDP per capita.