U.S. Homeowners ROE Improving But Florida Falls Behind

The after-tax return-on-equity (ROE) for U.S. homeowners insurance business jumped in 2015 helped by imploding reinsurance prices and catastrophe experience that pushed back loss ratios, according to a study release last week by Aon Benfield.

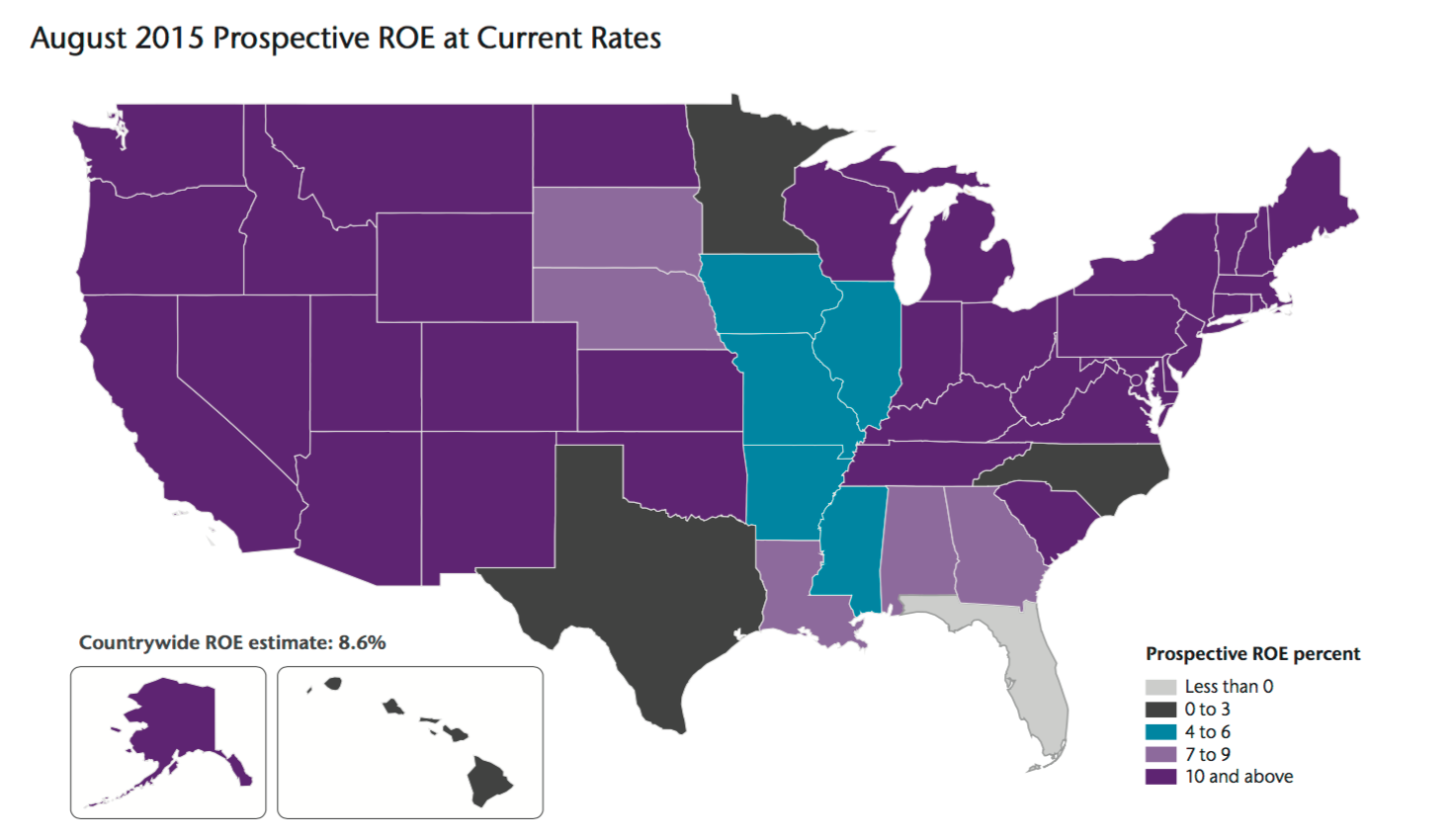

The report reveals that U.S. homeowner insurers’ prospective ROE is 8.6 percent on average this year, up from 7.9 percent in 2014.

The jump in ROE is attributed to three “key” factors, according to Aon Benfield, including improved primary insurance rates in several states, declines in estimated catastrophe loss ratios and decreasing reinsurance costs.

“The footprint of profitable growth opportunities continues to expand for the homeowners line of business, with positive rate momentum being maintained,” said Greg Heerde, Head of Aon Benfield Analytics Americas in a statement accompanying the report. “We continue to see increased utilization of risk-adjusted pricing methods and the development of by-peril rating plans.”

Positive premium trends were a significant driver of 70 basis point ROE bump in 2015, with rate increases averaging 4 percent in U.S. homeowners lines during the 18 months through the study’s August 2015 end date. Areas with the biggest premium increases included the midwest and tornado alley states in the belt from Texas to North Dakota which have seen “significantly adverse tornado and hail experience in the last three to five years.”

The report adds that although U.S. rate activity slowed nationwide, it was consistent with “findings that more states are nearing ROE target hurdle rates”

In addition, the report adds that also pushing ROE numbers is a ten year nationwide experience catastrophe loss ratio of 15 percent, 400 basis points below the modeled expected catastrophe loss ratio. The lack of catastrophe experience was even more striking for coastal states, where the ten year catastrophe loss experience was 17 loss ratio points compared to a modeled expectation of 25 points.

Florida continues to be the outlier in the good news for homeowners ROE, dragging behind every state. Aon Benfield explained that “Florida primary rates fell preventing carriers from realizing ROE improvements despite reduced reinsurance costs.”

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.