Thanks for previously subscribing to the Risk Market News newsletter. We have restarted publishing and switched email platforms. We are also changing to a paid subscription model in 2020, but as a thank your for your earlier interest we will continue sending you the subscriber-only newsletter through January 1.

Again, thanks for your interest and feel free to contact me using the button below with any questions, thoughts or input.

US Pushes Ahead With Hemp Crop Insurance

Rules for establishing a federal crop insurance program for the U.S. hemp market are being finalized by the United States Department of Agriculture (USDA), according to regulatory filings. Once approved, the rules would “provide hemp producers with crop insurance programs, potentially reducing risk to producers and providing easier access to capital,” a USDA proposal says.

The 2018 Farm Bill declassified hemp as a controlled substance and allowed the Federal Crop Insurance Corporation to offer coverage under the Disaster Relief Act starting in 2020.

The proposed rules specifically call out for the involvement of the private market:

In addition, [agencies should] provide financial incentives and support used by agricultural producers and private sector entities. These agencies similarly need regulatory guidance to develop commercial instruments such as loan documents, re-insurance contracts, and commodity disaster program provisions that are typically done on a crop year basis.

Marijuana and hemp growers are faced with unique risk challenges related to weather and catastrophe loss. Although about 230,000 acres of hemp were planted in the United States in 2019, only about 40 to 60 percent, or 115,000 to 138,000 acres, will be harvested because of wet weather and mold damage.

The private insurance and reinsurance sector is already exploring lines and limits against the associated businesses selling hemp, marijuana and derivatives like cannabidiol (CBD) and tetrahydrocannabinol (THC). A report by rating agency AM Best issued in March said that loss experience will be key to the hemp insurance market’s growth for those liability lines:

As the industry matures and insurers have greater statistics on actual loss history, insightful actuarial data and more clarity on the effects of cannabis, more carriers are likely to enter the market.

Oregon Proposal Would Surcharge Insurers to Fund Wildfire

After failing to pass legislation this spring that would have taxed insurance premiums to fund wildfire prevention and preparedness, Oregon lawmakers are now planning to propose a flat $5 premium surcharge.

Oregon Public Lands Commissioner Hilary Franz told the Seattle Times that Democrats would propose the surcharge in the shortened 60 legislative session. The surcharge is projected to raise $126 million per two-year budget cycle.

“Under the new proposal, a family with one home and two cars insured would pay “$15 a year to significantly improve” wildfire response, said Rep. Joe Fitzgibbon, D-West Seattle, who will sponsor the bill in the House.

“I think there’s a good case for everybody in the state to chip in for preventing catastrophes like that in the future,” he said.

The bill that would have taxed premiums failed last year after the insurance industry successfuly argued it would trigger retaliatory taxes for a Washington-based insurer in other states.

What Carney Has Said About The Private Market Role In Catastrophes

Mark Carney, set to retire as head of the Bank of England in January, will become the U.N. special envoy on climate action and climate finance. While at the BoE, the 54 year-old Canadian has been an outspoken proponent of private market solutions to increased catastrophe risk.

Remarks given during the UN Secretary General’s Climate Action Summit 2019

Both sides of insurers’ balance sheets need to respond.

On the liability side, the focus must be reducing the protection gap and supporting the resilience of households and companies to growing climate risks.

Better understanding of past losses can obviously help. Projects like the open-source Oasis Loss Modelling Framework of the IDF are leveraging the expertise of the private sector, the public sector and academia to improve the data available for risk analysis in low and middle income countries.

Speech on climate change and financial stability at Lloyd’s of London 2015

While the ability to re-price or withdraw cover mitigates some risk to an insurer, as climate change progresses, insurers need to be wary of cognitive dissonance within their organisations whereby prudent decisions by underwriters lead to falls in the value of properties held by the firm’s asset managers. This highlights the transition risk from climate change.

Today’s Risk Reads

Insurers quit Ireland over Brexit restrictions (The Times)

More than 200 foreign insurance companies have chosen to pull out of Ireland in the past five years because of high claims and their fears of restrictions on trading across borders after Brexit.

Paul Singer Has Been Called a ‘Doomsday Investor.’ Now He’s Hoping for Calm Waters.

A record number of natural disasters is testing the upstart firms that have made insurance investable, but Elliott Management pick Aeolus Capital emerges as a winner.

NSW bushfires are the EU's largest emergency mapping operation of 2019 (SBS Australia)

A European Union team has undertaken its largest emergency mapping operation of 2019 to help fight the recent bushfires that ravaged New South Wales.

Time to pass agricultural insurance legislation

Agricultural insurance is common in many other countries, and while Taiwan has been slow in adopting the practice, efforts with pilot cases are leading to improvements and results, and change is happening.

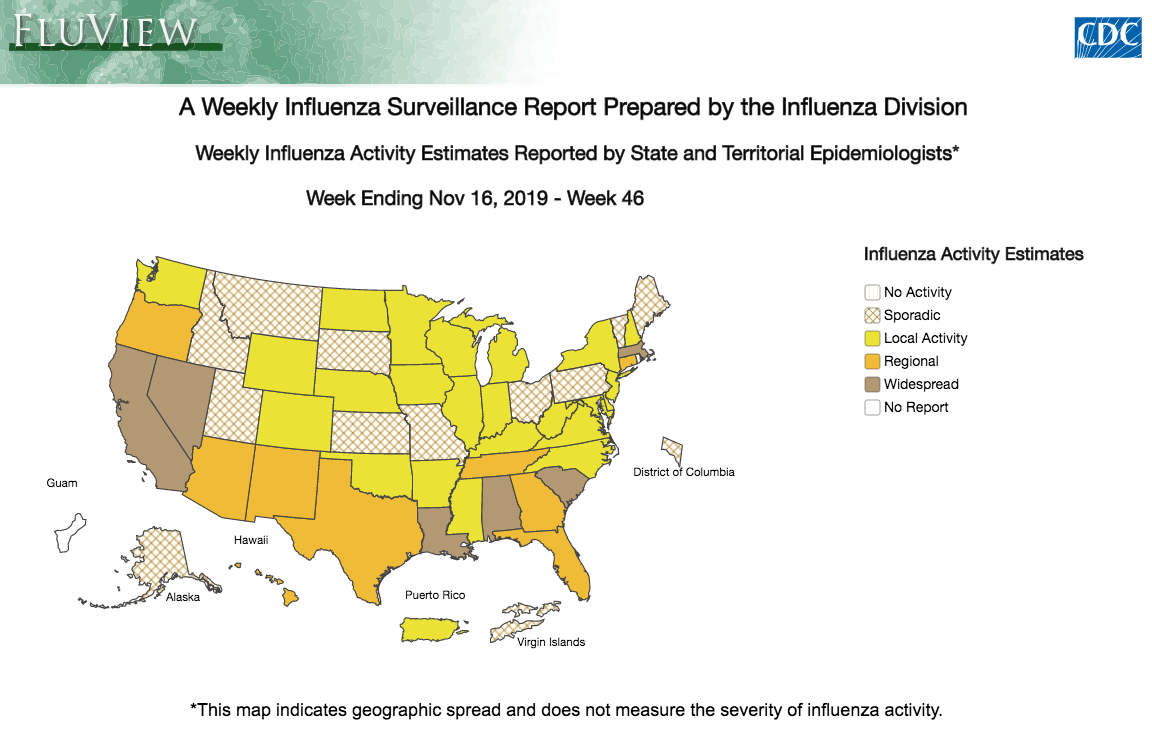

Risk Chart