In the decade following Hurricane Sandy US capital markets are no longer shrugging off the economic fallout of hurricanes, correcting a historic “under reaction” to extreme weather events, according to new research from the Federal Reserve Bank of San Francisco.

According to the economists, the volatility risk premium for options on publicly traded companies with operations within a 200-mile radius around the eye of a hurricane inverted following the superstorm.

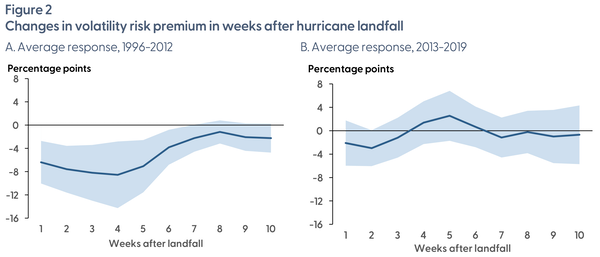

According to the data, the typical post-hurricane landfall volatility risk premium was negative prior to Sandy and represented investor “under reaction” to hurricanes. But in the decade since Hurricane Sandy, the typical post-hurricane landfall volatility risk premium is higher indicating that investors are more cautious about hurricane impacted equities.

There are several ingredients and assumption fueling the options volatility the research said, including destroyed physical assets, lost sales, evacuations, and shutting down and restarting of plant operations. Access to insurance, given the lengthy claims process, also figured into the volatility mix.

“[Because] adaptation and insurance are costly and not always available, incomplete insurance or adaptation can leave some firms facing significant lossesafter extreme weather events,” they added.

A key to the about face in markets’ reaction to Hurricane Sandy, in particular, may be attributed to its effect on Manhattan

“We consider Hurricane Sandy, which in 2012 caused unprecedented damage in the New York City metro area, the financial capital of the United States,” the economists said. “We find that investor under reaction to hurricanes diminished after Hurricane Sandy, suggesting that the informational efficiency of markets improved after this particularly salient extreme weather event that many investors experienced personally.”