Private Equity-Backed Life Insurers, Reinsurers Should Expect "Intrusive" Valuation Checks

Global and US regulators are preparing for a focus on private equity's valuation practices in life insurance and reinsurance.

Thanks for subscribing to the free Sunday newsletter version of RMN. Below are some of the stories that weekday subscribers were able to access.

Business Can’t Rely On Private Market Insurance In the Next Pandemic

Bermuda Insurers Ramp Up Capital to Cover Model Error 🔏

Australia Cyclone Reinsurance Pool Continues to Face Model, Structure Challenges 🔏

California’s Wildfire Model Push Will Take Time: Lara 🔏

Consider becoming a paid subscribing to RMN.

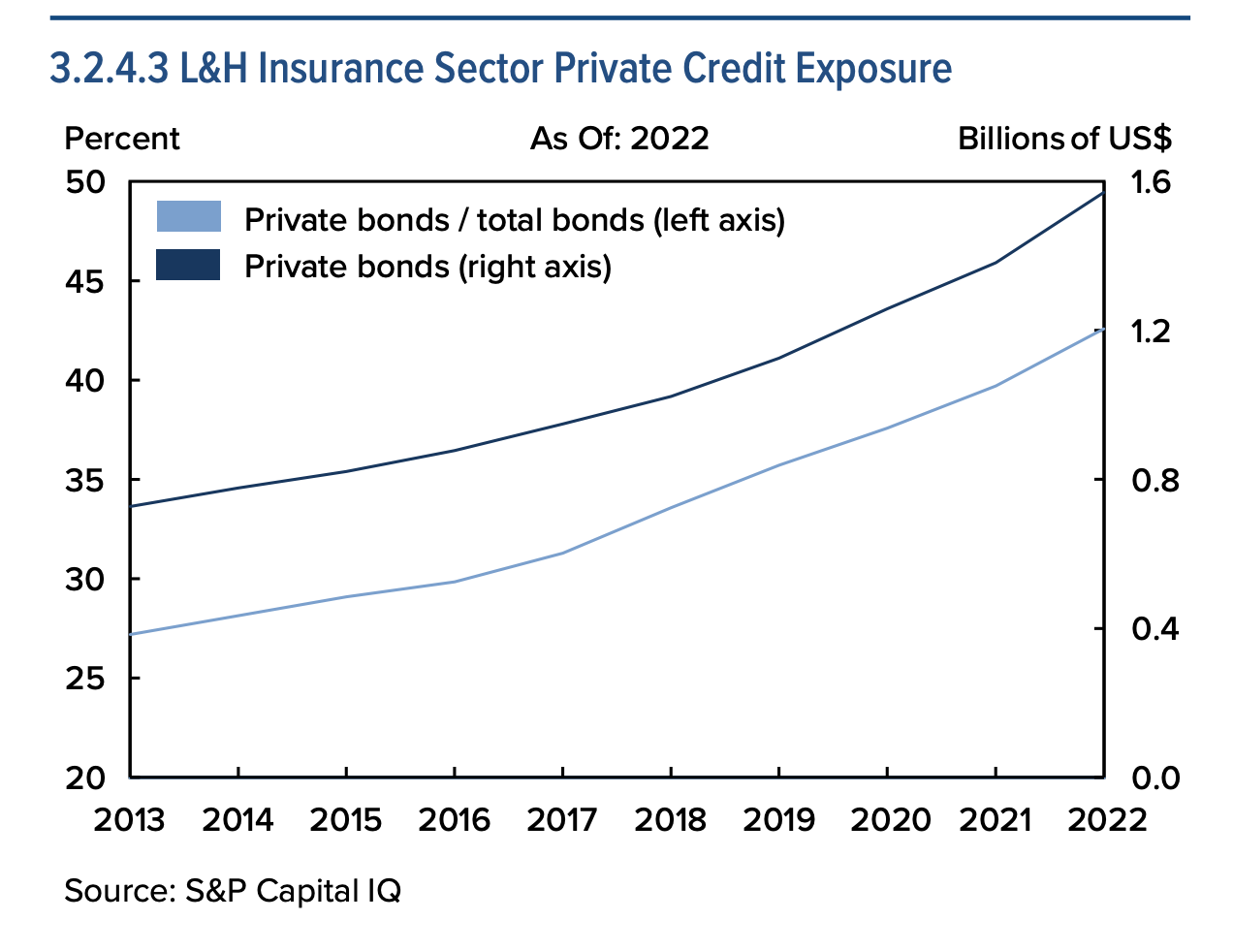

The growth of private capital throughout the capital markets is a continuing theme, whether it is in the form of the increase in private credit or in PE-backed participation within industries like healthcare.

But as the Wall Street Journal points out, global regulators are turning their attention to PE's growing influence on life insurance and reinsurance and the systemic risk impact on the global economy.

Of particular concern is how private equity's approach to valuations could undercut their insurers' liquidity to cover claims and regulators seem to be preparing for aggressive and coordinated oversight.

"Valuation uncertainty should be addressed by intrusive supervisory review of insurers’ valuation process, supervisory review of audit processes, and asset quality review by the supervisor when necessary," says a report issued by the International Monetary Fund last month. "Differences between carrying values of securities and current and stressed market value proxies will reveal the extent to which life insurers’ capital is at risk.

The IMF added that the "significant increase" of private equity reinsurance transactions over the past several yeas "also suggests the importance of a robust valuation process for reinsurance technical provisions."

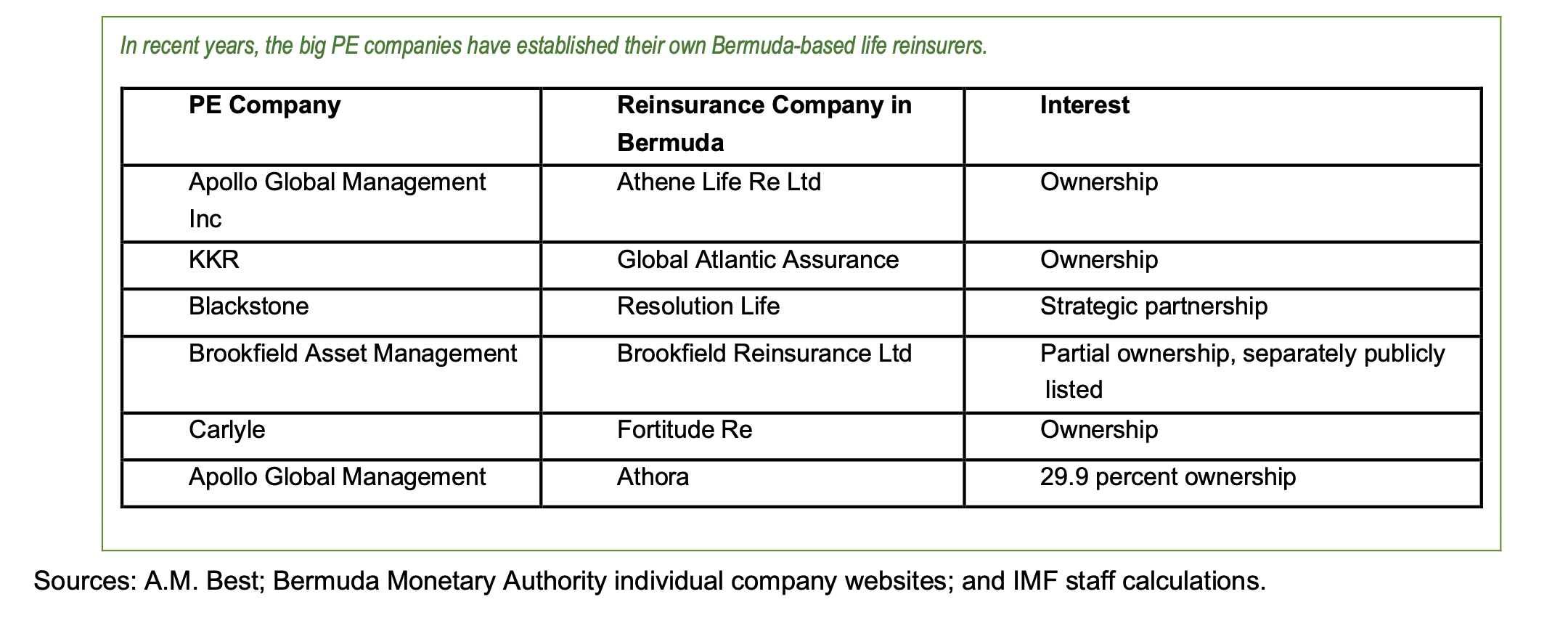

How offshore domiciles, like Bermuda, are apporoching valation for private equity backed insurers is also focus for the US Treasury's Financial Stability Oversight Council, which pointed out in its recent annual report that US life insurance and annuity reserves transferred offshore amounted to about 40 percent of the $2 trillion in total reserves ceded.

It added that PE-backed reinsurers accounted for 35.3 percent of all of the cedant life and annuity reserve credits and modified coinsurance reserves associated with reinsurance arrangement at the end of 2022.

The focus on valuation, and how the private equity sponsors model prices and losses, is of concern because private capital's approach to valuations does not traditionally respond to market or economic changes they way life insures have been constrained by when holding publicly traded securities.

"Typically, a life insurer has capital that is 10 percent or less of the value of its assets. A large allocation to private assets with valuation uncertainty means that the quality of this capital is more uncertain," the IMF report states, adding that the secondary market for PE assets where transactions in 2021 were priced at 92 percent of net asset value, but in 2022, this fell to 81 percent of net asset value.

The US FSOC also said that valuation will be a focus in 2024, especially for those in offshore domicles, such as Bermuda, that make "their balance sheets less transparent."

"Such regulatory challenges suggest a need to enhance supervisory, credit analysis, risk management, and capital frameworks to ensure policyholders are protected from heightened risks, FSOC's said.

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.