US Flood, Crop Cover Hole Getting Deeper

Australia needs to reprioritize it approach to catastrophes

US Flood, Crop Covers Aren’t Built to Cover Losses And It’s Only Getting Worse

U.S government programs that cover private properties from flood and agricultural crops from multiple natural perils weren’t “built” to cover their losses and climate change is only increasing the issues, according to a congressional report released last week.

A report from the General Accounting Office (GAO) says that both federally-backed insurance programs continue to dig bigger fiscal holes in the U.S. government budget.

From 2013 to 2017, losses paid under NFIP and the federal crop insurance program totaled $51.3 billion.25 Federal flood and crop insurance programs were not designed to generate sufficient funds to fully cover all losses and expenses, which means the programs need budget authority from Congress to operate. NFIP, for example, was about $21 billion in debt to the Department of the Treasury as of April 2019.26 Further, the Congressional Budget Office estimated in May 2019 that federal crop insurance would cost the federal government an average of about $8 billion annually from 2019 through 2029.

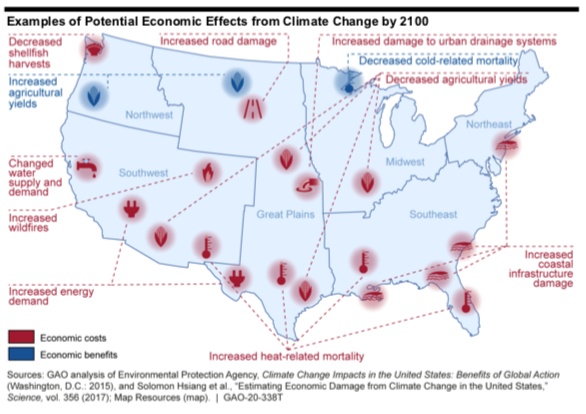

The report added that losses will be no be spread across the country evenly across the county.

For example, one of the studies estimated that the Southeast, Midwest, and Great Plains regions will likely experience greater combined economic effects than other regions, largely because of coastal property damage in the Southeast and changes in crop yields in the Midwest and Great Plains. This is consistent with the findings of the Fourth National Climate Assessment.11 For example, according to that assessment, the continued increase in the frequency and extent of high- tide flooding due to sea level rise threatens America’s trillion-dollar coastal property market and public infrastructure sector.

Thanks for giving the free version of Risk Market News a try. Given the short week, today’s post will be the last prior to the holiday. Subscribers will receive the regular newsletter on Thursday.

Not a paid subscriber? Use the button below to try out the paid version of RMN for two weeks.

Firm Argues Australia Needs to Reprioritize It’s Approach to Natural Peril Threats

Australia, besieged in recent years by successive bushfires, cyclones and floods, needs to shift its economic approach to natural disasters away from reconstruction and towards mitigation.

A report issued last week by Melbourne-based SGC Economics and Planning argues that analysis based on its spatial model suggests that the government overinvests in post-disaster reconstruction and underinvests in mitigation

While governments have made a significant effort to manage the impact of natural perils, their focus has been on repairing rather than protecting communities. Without a consistent, long-term and national approach, large parts of the country - including the most populated or economically valuable - remain exposed to natural perils.

The report adds that what the Australian government currently spends on mitigation is equivalent to 3% of what it spends on recovery and rebuilding efforts.

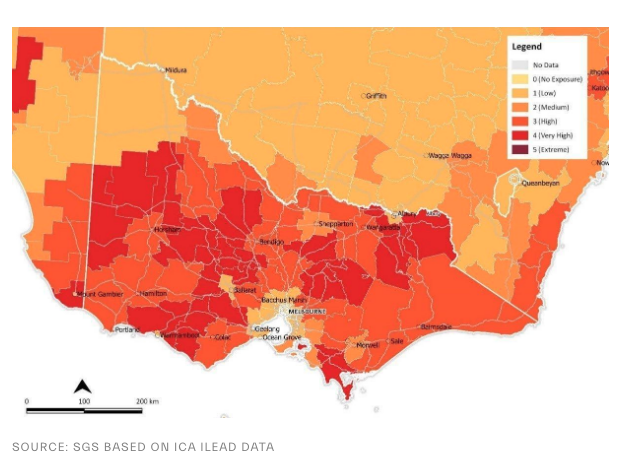

According to SGS, the firm used data from the Insurance Council of Australia and Insurance Group Australia used measured that information against natural peril risk levels provided by the and estimated resident population data for 2017-18. It then calculated risks at the Local Government Area (LGA) level.

The firm found that 4.2 million Queensland residents people live in areas with a high to extreme tropical cyclone risk and in Victoria, 17.1 per cent of the population live in communities at high to extreme risk of bushfire.

Risk Reads

Meet the scientists trying to understand the world’s worst wildfires (MIT Technology Review)

Today, though, after decades of drought and rising temperatures, monstrous blazes throughout the American West have brought the system’s weaknesses into focus. Rothermel’s model can’t deal with everything the environment is throwing at it, from the number of dead trees now standing in America’s forests to fluctuating wind speeds.

Insurers 'Sorry' For 15% Hike . . . But It's Worth It (Bahama Tribune)

Mr Saunders, revealing that RoyalStar and its reinsurance partners have set aside a $325m “gross reserve” to deal with some 1,800 Dorian-related claims, conceded that homeowners and businesses will be “challenged” to afford the necessary coverage in 2020.

Have Americans learned nothing from climate disasters? (Salon)

The United States has no single, national building code. The decision to adopt building codes lies in the hands of state and local jurisdictions, and so a patchwork of building- code standards stretches across the country.

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.