What Swiss Re Can, And Cannot, Model

Hong Kong puts it's risk money where its mouth is

Regular issues of RMN will be free to non-subscribers this week only. Take this opportunity of becoming a full subscriber at the discounted rate.

Swiss Re Study Questions Historical Loss Data…

A new report by Swiss Re argues that catastrophe models are relying too much on historical loss data and significantly underestimates potential losses as storm activity increases because of climate change.

In a Sigma report released today, the Zurich-based reinsurer says that many of today's catastrophe models do not fully account for rising exposures because they don’t reflect the current level of urbanization and development that is being subject to increased storm activity because of climate change.

To uphold the insurance risk transfer model as a powerful tool to foster resilience, insurers need to adapt before, not post events," Martin Bertogg, Head of Catastrophe Perils at Swiss Re said. "To this end, insurers should be wary of historical loss records in understanding today's state of the socio-economic environment and climate. Averaging out over a past spanning multiple decades can lead to distorted risk assessment.

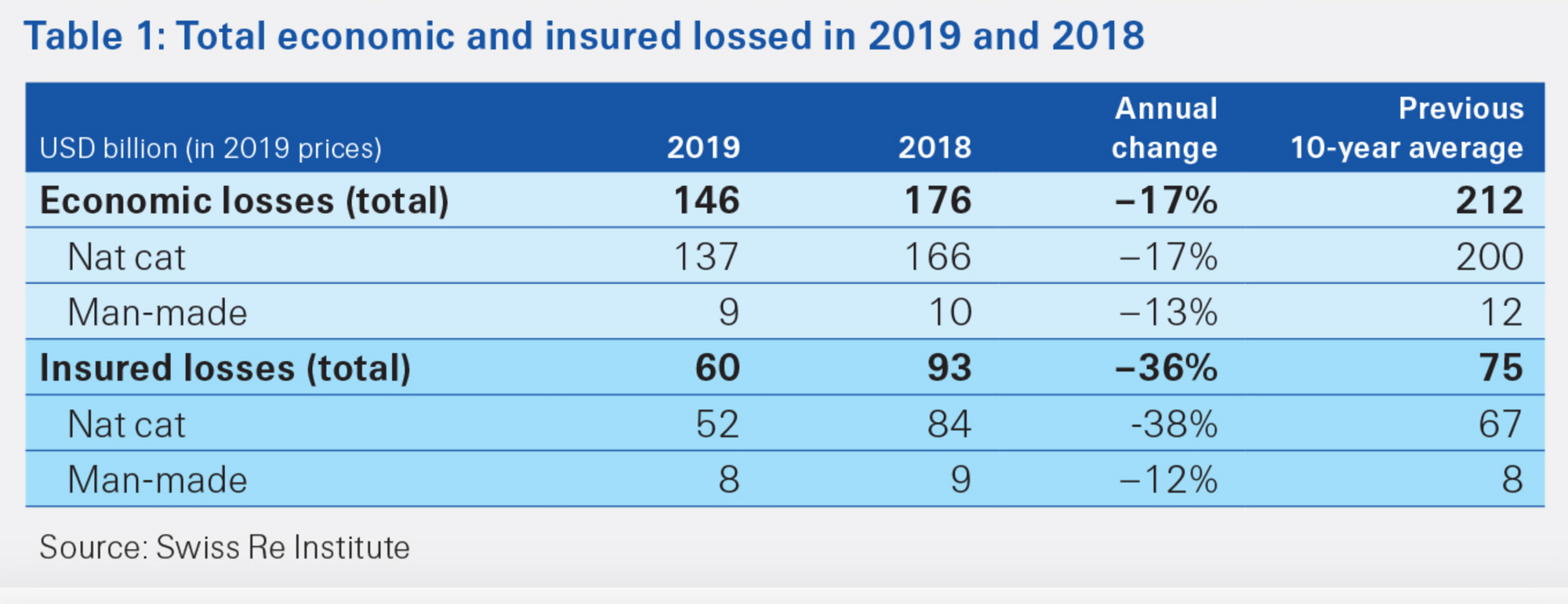

Swiss Re adds that worldwide economic losses from natural and man-made disasters in 2019 were $146 billion, lower than $176 billion in 2018 and the previous 10-year annual average of $212 billion. The biggest industry loss events of 2019 happened in densely populated and developed parts of Japan, including Typhoon Faxai in September followed by Typhoon Hagibis in October.

…While The Reinsurer Says It Can’t Model a COVID-19 Outcome

In a separate statement yesterday, Swiss Re said that although the reinsurer’s pandemic model is robust it can’t predict or model the outcome of the current COVID-19 outbreak

Swiss Re’s pandemic model, developed after the 2006 SARS outbreak and models 50,000 different pandemic scenarios, can’t isolate the COVID-19 pandemic and predict the financial impact because it will be “unique” in terms of insurance impact, lives lost and its impact on the global economy.

We need to be extremely careful about making assumptions, drawing conclusions or extrapolating from the model to the current specific situation. For example, the underlying populations used in the modeled scenarios are different from the general population. In our model, the results are based on an insured population and not comparable to the statistics we read in the media, which might be based on a percentage of the total population, or a percentage of people known to have the disease.

Hong Kong Fuels Risk Market War Chest by $400M

Hong Kong’s is increasing its 2020-2021 budget by $400 million, for a total of $2.3 billion, in its effort to steal away the risk market crown from London when it comes to reinsurance and insurance-linked securities.

In a statement last week, Secretary for Financial Services and the Treasury James Lau, set out Hong Kong’s priorities for the financial services industry in general and the risk market in particular:

To enhance Hong Kong's competitiveness as an international insurance hub and help the industry seize new opportunities, including those arising from the development of the Guangdong-Hong Kong-Macao Greater Bay Area and the Belt and Road Initiative, we introduced an amendment bill into the LegCo for scrutiny in this legislative session and gazetted two other amendment bills in March 2020. The amendment bills aim to serve the following purposes.

First, to reduce by 50 per cent the profits tax rate for all general reinsurance business of direct insurers, selected general insurance business of direct insurers and selected insurance brokerage business, so as to help promote the development of marine insurance, underwriting of specialty risks and high value-added maritime services.

Second, to establish a new regulatory regime which facilitates the issuance of insurance-linked securities in Hong Kong and to expand the scope of insurable risks by captive insurers set up in Hong Kong, thereby enriching the risk management tools available in the Hong Kong market and catering for the risk management needs of multinational companies respectively.

Third, to enhance the structure for the supervision of insurance groups where the holding company for the group is incorporated in Hong Kong, with a view to meeting international standards and establishing Hong Kong as a preferred base for large insurance groups in Asia Pacific.

Risk Market News Newsletter

Join the newsletter to receive the latest updates in your inbox.